Table of Contents

Table of Contents

Regulatory Framework

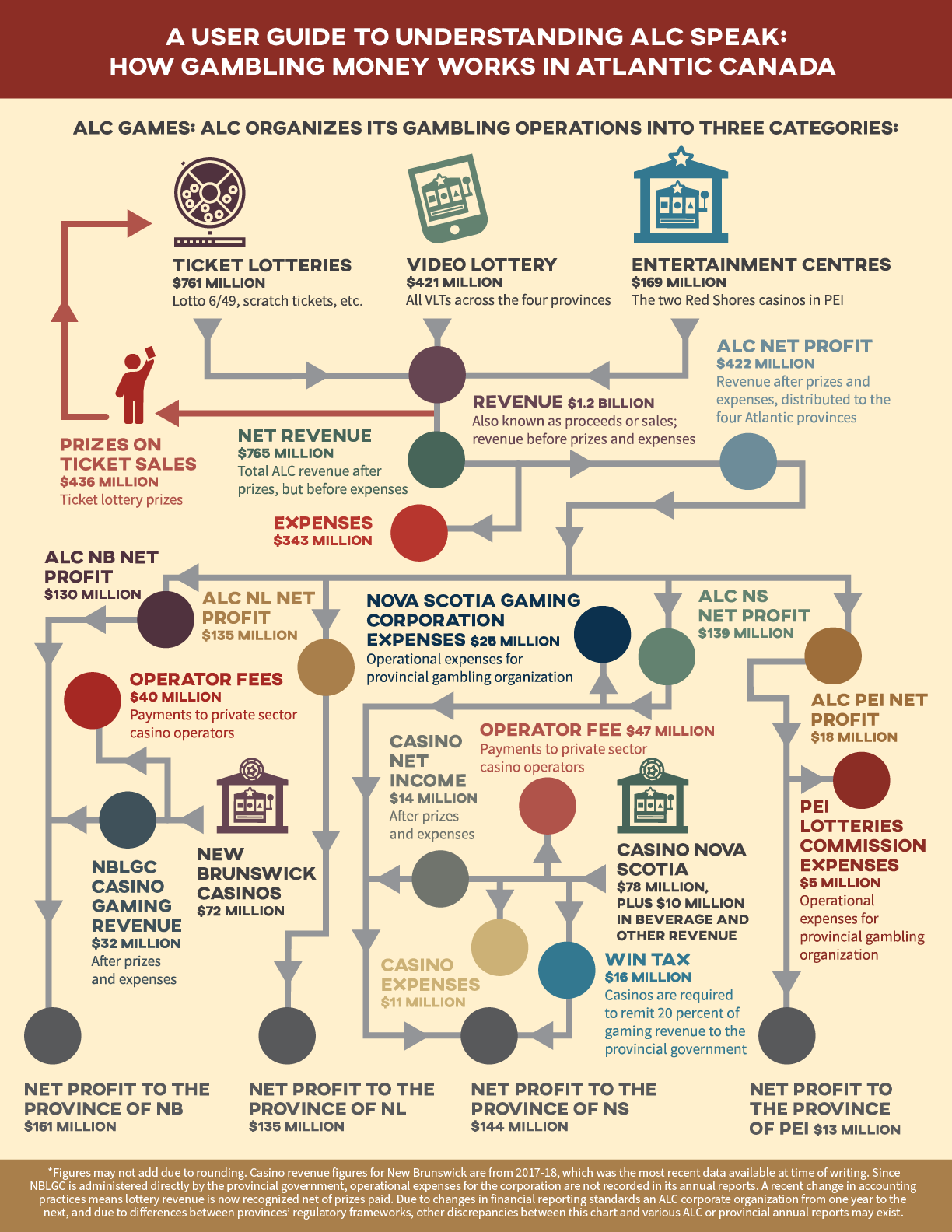

Most gambling activities in the Atlantic region have been managed by the Atlantic Lottery Corporation (ALC) since its creation in 1976. All four Atlantic provinces are members of ALC, which runs ticket lotteries and the region’s network of 6,300 video lottery terminals (VLTs) on behalf of the Atlantic provincial governments. ALC is also responsible for the two Red Shores casinos, which offer horse racing, table games, and slot machines in Charlottetown and Summerside, Prince Edward Island. 1 1 ALC, “ALC Annual Report 2018–19,” https://gamingns.ca/wp-content/uploads/2019/07/NSGC-Financial-Statements-March-31-2019-Final-website-1.pdf, https://www2.gnb.ca/content/dam/gnb/Departments/fin/pdf/NBLGC-SLJNB/AnnualReport-RapportAnnuel/AnnualReport2017-2018.pdf.

Gambling profits generated by the ALC are distributed to the four provinces according to each province’s share of gambling sales. The province of Newfoundland and Labrador receives its share of ALC profits directly. In Prince Edward Island, gambling profits flow through the Prince Edward Island Lotteries Commission. The provincial gambling corporations of Nova Scotia (the Nova Scotia Gaming Corporation) and New Brunswick (the New Brunswick Lotteries and Gaming Corporation) have somewhat more responsibility, as they also oversee casinos within their respective provinces. These casinos—Casino Nova Scotia, with locations in Halifax and Sydney, Casino New Brunswick, and Grey Rock Casino—are owned and operated by private-sector operators. 2 2 New Brunswick Finance and Treasury Board, “Gaming in New Brunswick,” https://www2.gnb.ca/content/gnb/en/departments/finance/lotteries_and_gaming_corporation/gaming_in_nb.html; Nova Scotia Gaming Corporation, “Frequently Asked Questions,” https://gamingns.ca/faq/; Prince Edward Island, “Lotteries Commission Act,” ttps://www.princeedwardisland.ca/en/legislation/lotteries-commission-act; Government of Newfoundland and Labrador, “Lotteries,” https://www.gov.nl.ca/snl/lotteries/. In each of the four Atlantic provinces, gambling profits, just like income taxes, are directed to the government’s general revenue fund and used to pay for public services. 3 3 New Brunswick Lotteries and Gaming Corporation, “Frequently Asked Questions,” July 4, 2018, https://www2.gnb.ca/content/dam/gnb/Departments/fin/pdf/NBLGC-SLJNB/NBLGC-FAQ.pdf; New Brunswick, “Public Accounts,” https://www2.gnb.ca/content/gnb/en/departments/finance/comptroller/content/public_accounts.html; Newfoundland and Labrador, “Public Accounts,” https://www.gov.nl.ca/fin/public-accounts/; Nova Scotia, “Public Accounts,” https://beta.novascotia.ca/public-accounts; Prince Edward Island, “Public Accounts for the Province of Prince Edward Island,” https://www.princeedwardisland.ca/en/information/finance/public-accounts.

Operations

Where the Money Comes From

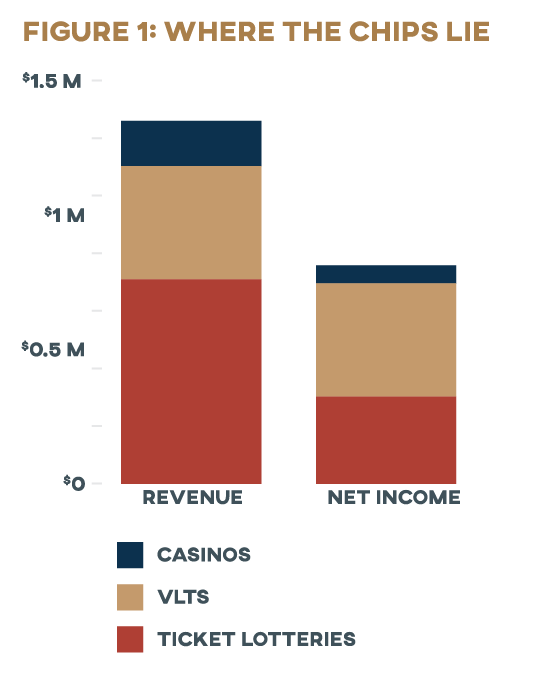

ALC generated just over $1.2 billion in gambling revenue during the 2018–19 fiscal year. This revenue comes from three main business lines: ticket lotteries, VLTs, and entertainment centres (i.e., Red Shores casino facilities). Of the different game types, the largest share of ALC gambling sales comes from ticket lotteries, which brought in about 56 percent of total sales, at $761 million. The other major sales source is VLTs, which took in another 31 percent, at $421 million. Casino revenue made up the final 13 percent, with sales of $169 million. New Brunswick and Nova Scotia contributed an additional $72 million and $78 million, respectively, in casino sales, bringing the Atlantic region’s total gambling sales to $1.35 billion (Figure 1).

Prize payments and revenue allocations to casino operators shift the overall profitability of these games. VLTs, the most addictive medium (see below) are also the most profitable: 52 percent of net revenue came from VLTs. Ticket lotteries fall to second place, at 40 percent of net revenue, while casinos were a distant third, at 8 percent. 4 4 ALC, “ALC Annual Report 2018–19.” At time of writing, NBLGC had not published its 2018–19 annual report, so New Brunswick casino revenue figures from 2017–18 are stated here.

Where the Money Goes

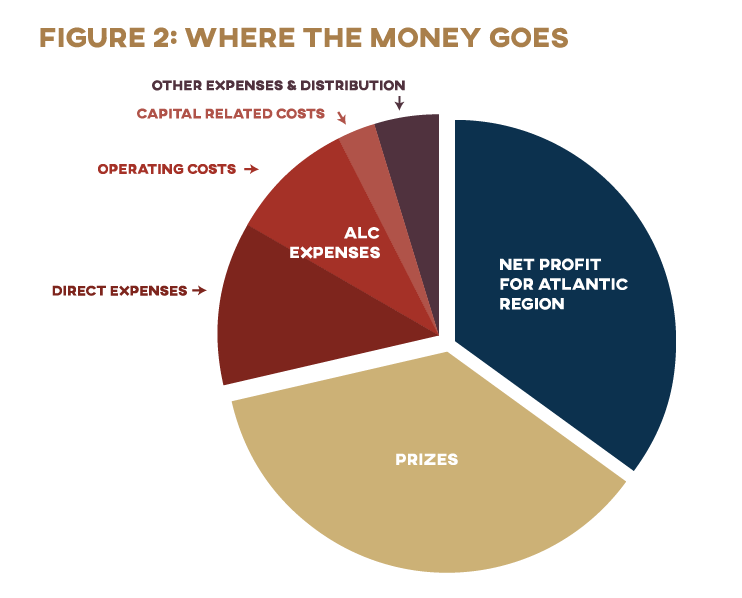

ALC’s revenue is destined for many pots. 5 5 Since limited data were available for non-ALC provincial casino operations, figures used here represent ALC operations only. The corporation’s largest expense is prizes on ticket lottery sales: $436 million was paid out to winners across the region last year. Direct expenses, such as commissions to private-sector retailers and ticket printing, were a distant second, at $143 million. Other operating and administrative expenses—including employee costs and VLT leases—totaled $110 million. The corporation also spent $34 million on capital-related costs and $56 million to cover other expenses and distributions. Everything left over after all these bills were paid—$422 million, just under two-fifths of the corporation’s total revenue—was distributed to the Atlantic provincial governments (Figure 2). 6 6 ALC, “ALC Annual Report 2018–19.”

Who's Hooked? Gambling Profits as a Proportion of Provincial Revenue

Gambling has become a lucrative source of funds for the Atlantic region since ALC ran its first lottery in 1976. In that first year of operation, the corporation made a modest $5.2 million profit for its four provincial shareholders from $11.5 million in lottery sales; last year, the region’s $1.3 billion in gambling sales brought $461 million into provincial coffers.

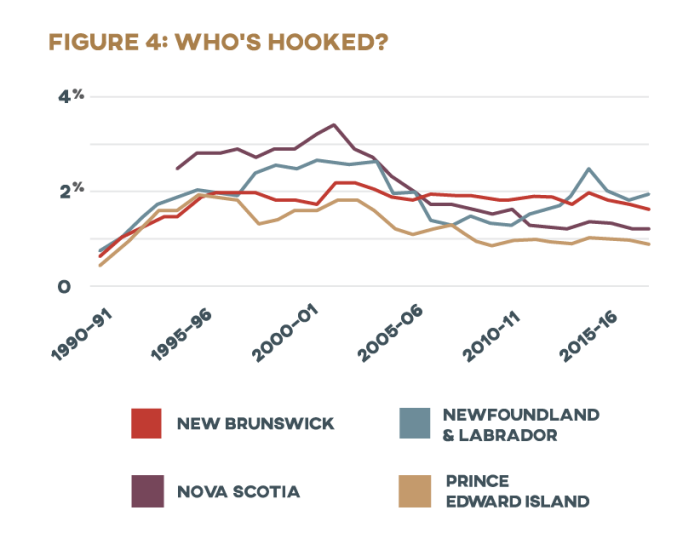

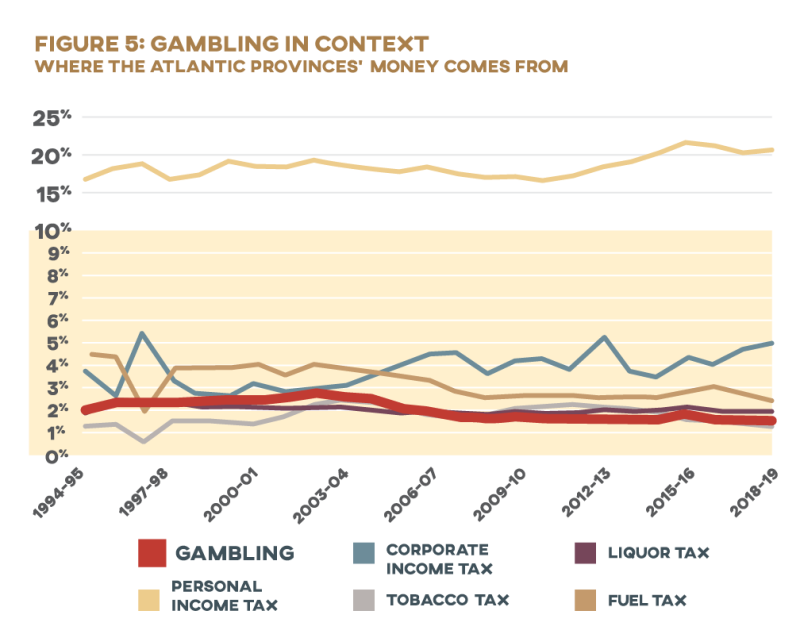

As the gambling industry has grown in the Atlantic provinces, so too has the provincial governments’ reliance on it as a source of revenue. Each Atlantic province now collects between 1 and 2 percent of its income at casinos, VLT lounges, and lottery checkout lanes (Figure 3). 7 7 New Brunswick, “Public Accounts”; Newfoundland and Labrador, “Public Accounts”; Nova Scotia, “Public Accounts”; Prince Edward Island, “Public Accounts for the Province of Prince Edward Island.”

But where is this money coming from? Who, and what communities, are the source of these funds (Figures 4 and 5)?

P(l)ayer Profile: Gambling Demographics

Most of Atlantic Canada’s population is paying into the pockets of ALC in one form or another. Survey data indicate that around four in five Atlantic Canadians gamble in a given year (PEI 82%, NL 77%, NS 73%, NB 85%). 8 8 J. Doiron, “Gambling and Problem Gambling in Prince Edward Island,” Prince Edward Island Department of Health, 2006, 9, https://prism.ucalgary.ca/handle/1880/48204; “2009 Newfoundland and Labrador Gambling Prevalence Study,” Department of Health and Community Services, Government of Newfoundland and Labrador, 2009, 15, https://prism.ucalgary.ca/handle/1880/47656; Nova Scotia Department of Health and Wellness, “2013 Nova Scotia Adult Gambling Information Collection Project,” 2016, 16, https://novascotia.ca/dhw/publications/Adult-Gambling-Information-Collection-Project-2013.pdf; New Brunswick Department of Health, “2014 New Brunswick Gambling Prevalence Study,” May 27, 2015, 23, https://prism.ucalgary.ca/bitstream/handle/1880/110135/GamblingPrevelanceStudy.pdf?sequence=1&isAllowed=y. This is roughly consistent with estimates of the Canada-wide average (which hovers around 70–80 percent 9 9 Katherine Marshall, “Gambling 2011,” Statistics Canada, Perspectives on Labour and Income, Winter 2011, https://www150.statcan.gc.ca/n1/pub/75-001-x/2011004/article/11551-eng.htm, 6; John McCready et al., “Gambling and Seniors: Sociodemographic and Mental Health Factors Associated with Problem Gambling in Older Adults in Canada,” report on research award for the Ontario Problem Gambling Research Centre, April 2010, 57, https://www.greo.ca/Modules/EvidenceCentre/Details/gambling-and-seniors-sociodemographic-and-mental-health-factors-associated-problem-gamblin-1; M. MacDonald, J. L. McMullan, and D.C. Perrier, “Gambling Households in Canada,” Journal of Gambling Studies 20, no. 3 (Fall 2004): 194. ).

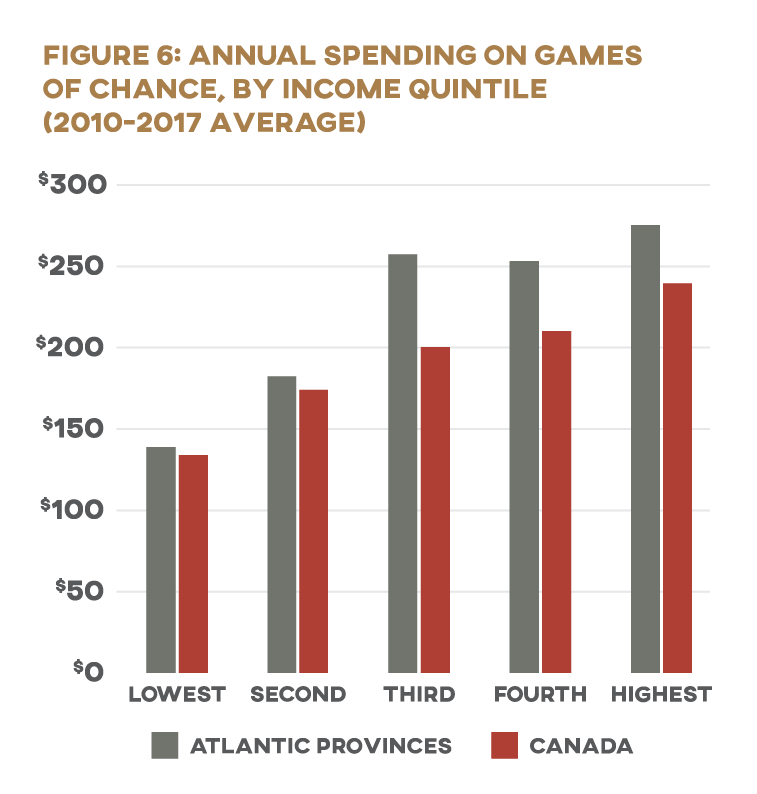

Money In, Money Out: Gambling Spending by Income

Atlantic Canada’s population is not, however, paying ALC equally. The regressive nature of gambling revenue is hard to see on the surface. The data collected by Statistics Canada’s Survey of Household Spending (SHS) seem to show that those who have more money are more likely to gamble and to spend more money when they do: the average household in Canada’s highest-income quintile spends $240 on gambling each year, while the average lowest-quintile household spends a mere $134. A similar pattern emerges for the Atlantic region: highest-quintile households report spending $276, while those in the lowest quintile report spending only $139 (Figure 6). 10 10 Author’s calculations based on data from Statistics Canada, “Table 11-10-0223-01: Household Spending by Household Income Quintile, Canada, Regions and Provinces,” https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110022301. For detailed calculation methodology, see B. Dijkema and J. Wolfert, Pressing Its Luck: How Ontario Lottery and Gaming Can Work For, Not Against, Low-Income Households (Cardus, 2020), https://www.cardus.ca/research/work-economics/reports/pressing-its-luck/.

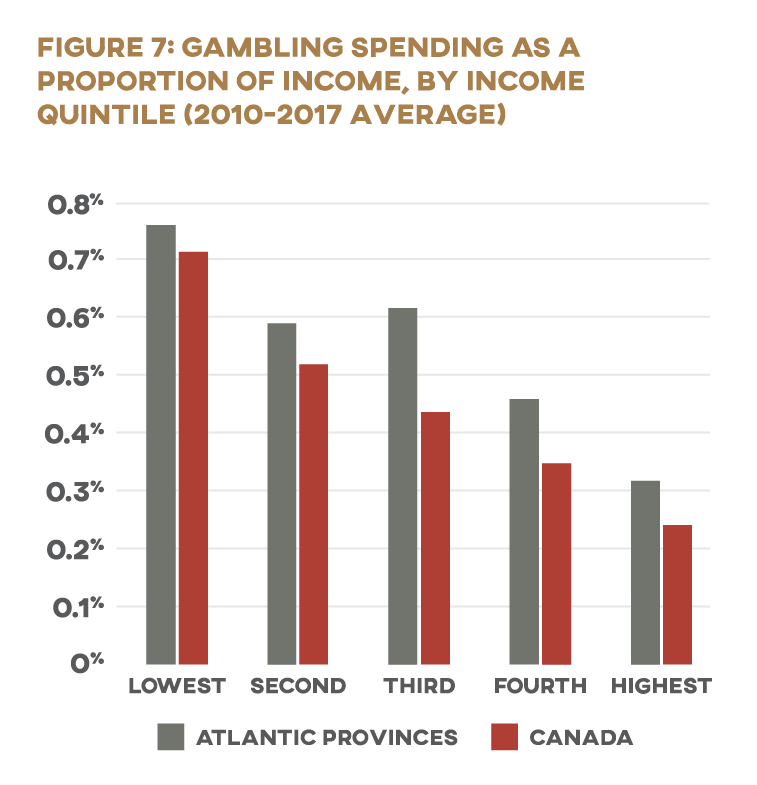

But first glances can be deceptive. Higher earners may be spending more of their paycheques at the casino, but gambling eats up a much higher proportion of the poor’s income. According to SHS data, Atlantic Canada’s poorest households spent more than twice as much of their income on gambling as did the richest (0.76 percent compared to 0.32 percent). Households in Canada’s highest-income quintile spent an average of 0.24 percent of their after-tax earnings on games of chance each year;

those in the lowest quintile spent nearly three times as much, at 0.71 percent (Figure 7).

11

11

All figures are author’s calculations based on data from Statistics Canada’s Canada Income Survey and Survey of Household

Spending. Statistics Canada, “Household Spending by Household Income Quintile, Canada, Regions and Provinces”; User Guide to the Survey of Household Spending, 2015 (Ottawa: Income Statistics Division, 2017), https://www150.statcan.gc.ca/n1/en/catalogue/62F0026M2017001; Statistics Canada, “Table 11-10-0193-01: Upper Income Limit, Income Share and Average of Adjusted Market, Total and After-Tax Income by Income Decile,” https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110019301. For detailed calculation methodology, see Dijkema and Wolfert, Pressing Its Luck.

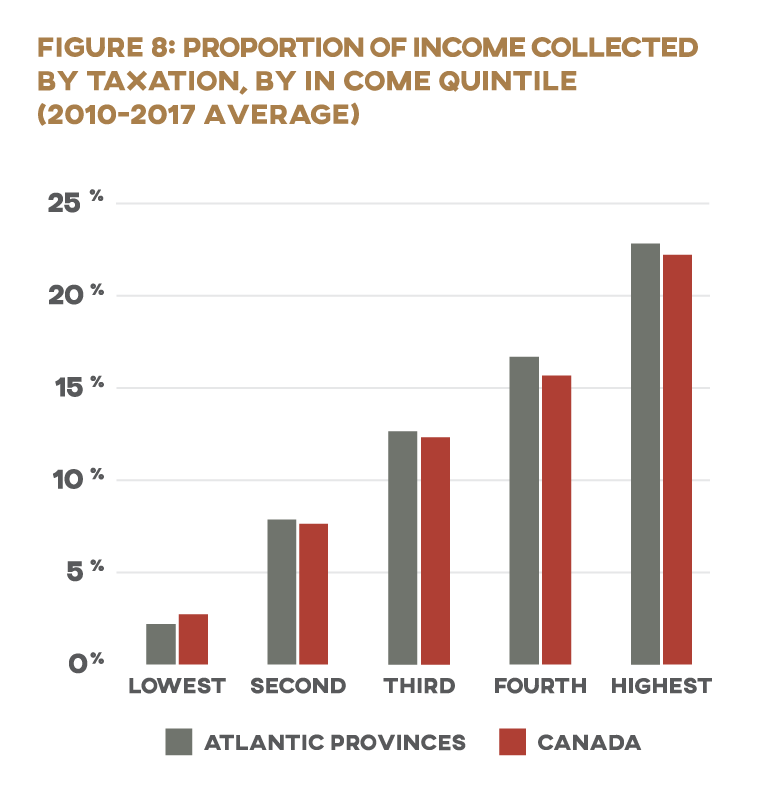

Less than 1 percent of a household’s annual earnings may not seem like a lot of money, even for a low income family. These seemingly low numbers, however, should not distract us from the high-stakes problem at play: when the Atlantic provincial governments collect lottery and casino money, they are digging deeper into the pockets of the poor than of the rich. Gambling may be a “voluntary” tax (more on the accuracy of this description below as well), but it’s a tax these governments are reliant

on nonetheless—which means the provinces are paying their bills in a way that hits low-income families hardest (Figure 8).

The regressive nature of gambling taxes is no secret: research both within Canada and internationally has consistently found that poor households spend a greater percentage of their income on gambling than their wealthier neighbours do.

13

13

See, e.g., R.J. Williams and R.A. Volberg, “Gambling and Problem Gambling in Ontario.” Report prepared for the Ontario Problem Gambling Research Centre and the Ontario Ministry of Health and Long-Term Care, June 2013. http://hdl.handle.net/10133/3378; MacDonald, McMullan, and Perrier, “Gambling Households in Canada”; J.D. Wisman, “State Lotteries: Using State Power to Fleece the Poor,” Journal of Economic Issues (Association for Evolutionary Economics) 40, no. 4 (December 2006): 955–66; J. Orford et al., “The Role of Social Factors in Gambling: Evidence from the 2007 British Gambling Prevalence Survey,” Community, Work & Family 13, no. 3 (August 2010): 258; T. Bol, B. Lancee, and S. Steijn, “Income Inequality and Gambling: A Panel Study in the United States (1980–1997),” Sociological Spectrum 34, no. 1 (January 2014): 64; K.B. Lang and M. Omori, “Can Demographic Variables Predict Lottery and Pari-Mutuel Losses? An Empirical Investigation,” Journal of Gambling Studies 25, no. 2 (June 2009): 173; S. Castrén et al., “The Relationship Between Gambling Expenditure, Sociodemographics, Health-Related Correlates and Gambling Behavior: A Cross-Sectional Population-Based Survey in Finland,” Addiction 113, no. 1 (2018): 91–92.

And yet this is exactly the opposite of how other tax revenue functions. Our progressive tax system is designed to tax the rich more heavily than the poor: those who have more pay more. The lowest-income quintile in the Atlantic provinces contributes just over 2 percent of its total income to federal and provincial income tax, while the average household in the province’s highest-income quintile turns over to the government nearly ten times more of its total income, at 23 percent.

14

14

Author’s calculations based on data from Statistics Canada, “Table 11-10-0193-01: Upper Income Limit, Income Share and Average of Adjusted Market, Total and After-Tax Income by Income Decile.” For detailed calculation methodology, see Dijkema and

Wolfert, Pressing Its Luck.

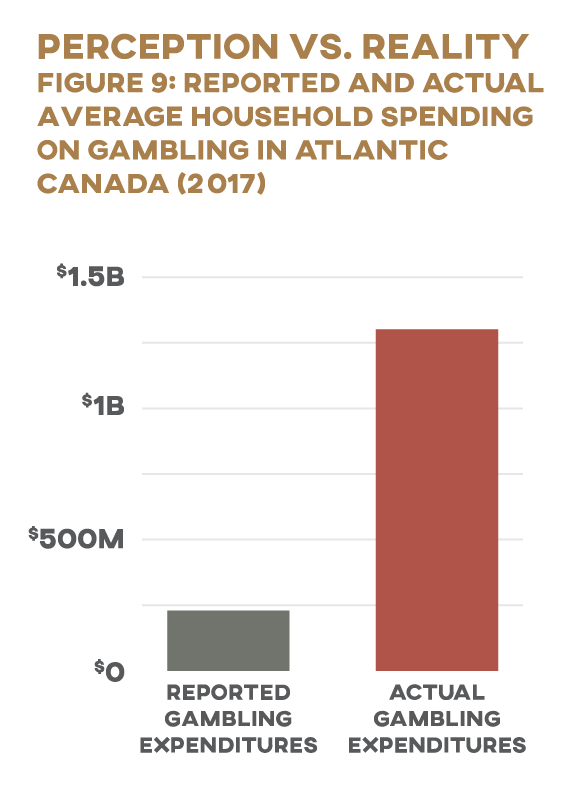

The Demographics Data Gap

Statistics Canada’s data on spending and income across the country provide a window into the relationship between gambling and household earnings. But these figures are not without their limitations. As with other addictions, most of us don’t want to admit we have a problem—but we’re gambling more than we think. According to SHS figures, the average Atlantic household spent $194 on games of chance in 2017. Multiply this figure by the number of households in the region that year (1.04 million 15 15 Statistics Canada, “Table 36-10-0101-01: Distributions of Household Economic Accounts, Number of Households, by Income Quintile and by Socio-demographic Characteristic,” https://www150.statcan.gc.ca/t1/tbl1/en/cv.action?pid=3610010101#timeframe. ), though, and Atlantic Canadians’ total gambling spending comes to only $203 million—a mere 15.6 percent of the gaming sales recorded by ALC and other provincial casinos that year ($1.3 billion 16 16 ALC, “Annual Report 2016–17,” https://www.alc.ca/content/dam/alc/docs-en/Corp/AboutAL/WhoisAL/AnnRepts/AnnualReport16-17-ENG.pdf. Figures adjusted for inflation. ). Put another way, the average household would have had to gamble almost $1,250 in 2017 for ALC’s books to balance. Indeed, the average match between Atlantic gambling corporations’ earnings and SHS expenditure data was only 17.7 percent from 2010 to 2017. This inconsistency is not uncommon: in self-reported household-expenditure surveys, people typically underestimate how much they actually spend gambling, often dramatically (Figure 9). 17 17 R.T. Wood and R.J. Williams, “‘How Much Money Do You Spend on Gambling?’ The Comparative Validity of Question Wordings Used to Assess Gambling Expenditure,” International Journal of Social Research Methodology 10, no. 1 (2007): 63–77.

Cause for Concern

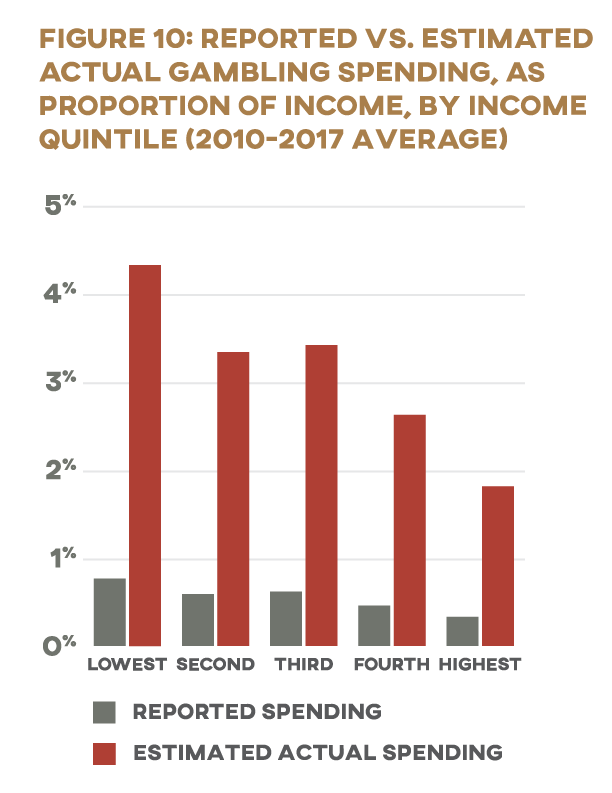

Though SHS data must be interpreted with caution, what we believe to be the core issue at hand remains: gambling disproportionately burdens the poor, a finding that not only is consistent across provinces in SHS data but is repeatedly borne out by other research as well. If households across all income quintiles are underestimating their gambling spending by approximately the same margin in their SHS expenditure records, it would mean that the lowestincome households in Atlantic Canada are spending almost 4.5 percent of their income—about $800 a year—on government-sponsored gambling (Figure 10). The Atlantic provincial governments use income taxes—which are set through a transparent process for which they are held publicly accountable—to collect an average of $2,000 from households making $9,125, and only $35 from households making $1,560. It then promotes games that its players are designed to lose, to take another $72 of what remains in the pockets of the poorest—an average of $1,525 for the month—but just $68 more ($140) from those who have $7,125 of their paycheques left to pay their monthly bills. 18 18 Author’s calculations based on AGLC Annual Reports and Statistics Canada, “Table 11-10-0223-01: Household Spending by Household Income Quintile, Canada, Regions and Provinces.” For detailed calculation methodology, see Dijkema and Wolfert, Pressing Its Luck.

There’s strong evidence that those at the margins of society are paying disproportionately into the coffers of ALC. Take, for example, Canadian and international studies that establish links between lower levels of education and higher levels of gambling participation. 19 19 See, e.g., Nova Scotia Department of Health and Wellness, “2013 Nova Scotia Adult Gambling Information Collection Project”; M. Abdel-Ghany and D.L. Sharpe, “Lottery Expenditures in Canada: Regional Analysis of Probability of Purchase, Amount of Purchase, and Incidence,” Family and Consumer Sciences Research Journal 30, no. 1 (2001): 64–78; MacDonald, McMullan, and Perrier, “Gambling Households in Canada”; Castrén et al., “The Relationship Between Gambling Expenditure, Socio-demographics, Health-Related Correlates and Gambling Behavior”; A. Tan, S. Yen, and R. Nayga Jr., “Socio-demographic Determinants of Gambling Participation and Expenditures: Evidence from Malaysia,” International Journal of Consumer Studies 34 (2010): 316–25; T. Davidson et al., Gambling Expenditure in the ACT (2014): By Level of Problem Gambling, Type of Activity, and Socioeconomic andDemographic Characteristics (Canberra: Australian National University, 2016), 11, https://www.gamblingandracing.act.gov.au/__data/assets/pdf_file/0010/982774/2014-Gambling-Expenditure.pdf; J. Beckert and M. Lutter, “The Inequality of Fair Play: Lottery Gambling and Social Stratification in Germany,” European Sociological Review 25, no. 4 (August 2009): 475–88. Given that lower levels of education are also linked to lower earnings, 20 20 S. Speer, “Forgotten People and Forgotten Places: Canada’s Economic Performance in the Age of Populism,” Macdonald-Laurier Institute, August 2019, https://macdonaldlaurier.ca/files/pdf/MLI_Speer_ScopingSeries1_FWeb.pdf. the overrepresentation of less-educated groups in the lottery market is likely to amplify the lottery’s regressive effect. Indigenous peoples also have disproportionately lower incomes compared to majority populations and as such are disproportionately affected by the expansion of gambling. 21 21 An in-depth review of the literature on gambling among Indigenous communities is beyond the scope of this paper, but readers are encouraged to explore the substantial body of research on this topic. See, e.g., H. Breen and S. Gainsbury, “Aboriginal Gambling and Problem Gambling: A Review,” International Journal of Mental Health and Addiction 11 (2013): 75–96; D. Wardman, N. El-Guebaly, and D. Hodgins, “Problem and Pathological Gambling in North American Aboriginal Populations: A Review of the Empirical Literature,” Journal of Gambling Studies 17, no. 2 (2001): 81–100; R.J. Williams, R.M.G. Stevens, and G. Nixon, “Gambling and Problem Gambling in North American Indigenous Peoples,” in First Nations Gaming in Canada, ed. Y. Belanger (Winnipeg: University of Manitoba Press, 2011), 166–94; New Zealand Ministry of Health, “Gambling and Problem Gambling: Results of the 2011/12 New Zealand Health Survey,” 2015, https://www.health.govt.nz/publication/gambling-and-problem-gambling-results2011-12-new-zealand-health-survey; L. Dyall, “Gambling: A Poison Chalice for Indigenous Peoples,” International Journal of Mental Health and Addiction 8 (2010): 205–13; Williams and Wood, The Demographic Sources of Ontario Gaming Revenue; M. Stevens and M. Young, “Betting on the Evidence: Reported Gambling Problems among the Indigenous Population of the Northern Territory,” Australian & New Zealand Journal of Public Health 33, no. 6 (December 2009): 556–65; C. Currie et al., “Racial Discrimination, Post Traumatic Stress, and Gambling Problems among Urban Aboriginal Adults in Canada,” Journal of Gambling Studies 29, no. 3 (2013): 393–415.

Research also suggests that the Atlantic provinces’ gambling addiction is being fed disproportionately by gambling addicts. Those classified as problem gamblers make up an estimated 1 percent to 2.5 percent of Atlantic Canada’s total adult population, depending on how problem gambling is defined and measured in a given survey (PEI 1%, NL 1.5%, NS 1.7%, NB 2.5%). 22 22 For a collected summary of provincial gambling prevalence studies conducted in Canada, see Alberta Gambling Research Institute, “Prevalence—Canada Provincial Studies,” last modified June 17, 2016, https://abgamblinginstitute.ca/resources/reference-sources/prevalence-canada-provincial-studies. The figures cited in the current paper represent problem-gambling rates that have been standardized (improving comparability between studies and over time) by the researchers who collected this summary of prevalence studies. As is the case for other addictions, there is an abundance of evidence suggesting that problem gambling is more likely to afflict society’s vulnerable and marginalized, having been linked to lower income, minority ethnic status, less formal education, alcohol abuse, and higher rates of psychiatric disorders. 23 23 For a concise overview of this research, see R. Volberg, L. McNamara, and K. Carris, “Risk Factors for Problem Gambling in California: Demographics, Comorbidities and Gambling Participation,” Journal of Gambling Studies 34 (2018): 360–63; see also F.K. Lorains, S. Cowlishaw, and S.A. Thomas, “Prevalence of Comorbid Disorders in Problem and Pathological Gambling: Systematic Review and Meta-Analysis of Population Surveys,” Addiction 106 (2011): 490–98; R. Williams, R. Volberg, and R. Stevens, “The Population Prevalence of Problem Gambling: Methodological Influences, Standardized Rates, Jurisdictional Differences, and Worldwide Trends,” report prepared for the Ontario Problem Gambling Research Centre and the Ontario Ministry of Health and Long-Term Care, February 2012, https://opus.uleth.ca/handle/10133/4838. Even after controlling for the effect of these mental-health risk factors, problem gamblers are more likely than the rest of the population to have attempted or thought about committing suicide. 24 24 H. Wardle et al., “Problem Gambling and Suicidal Thoughts, Suicide Attempts and Non-suicidal Self-Harm in England: Evidence from the Adult Psychiatric Morbidity Survey 2007,” research report for the Gambling Commission, May 2019, https://www.gamblingcommission.gov.uk/PDF/Report-1-Problem-gambling-and-suicidal-thoughts-suicide-attempts-and-non-suicidal-self-harmin-England-evidence-from-the-Adult-Psychiatric-Morbidity-Survey-2007.pdf.

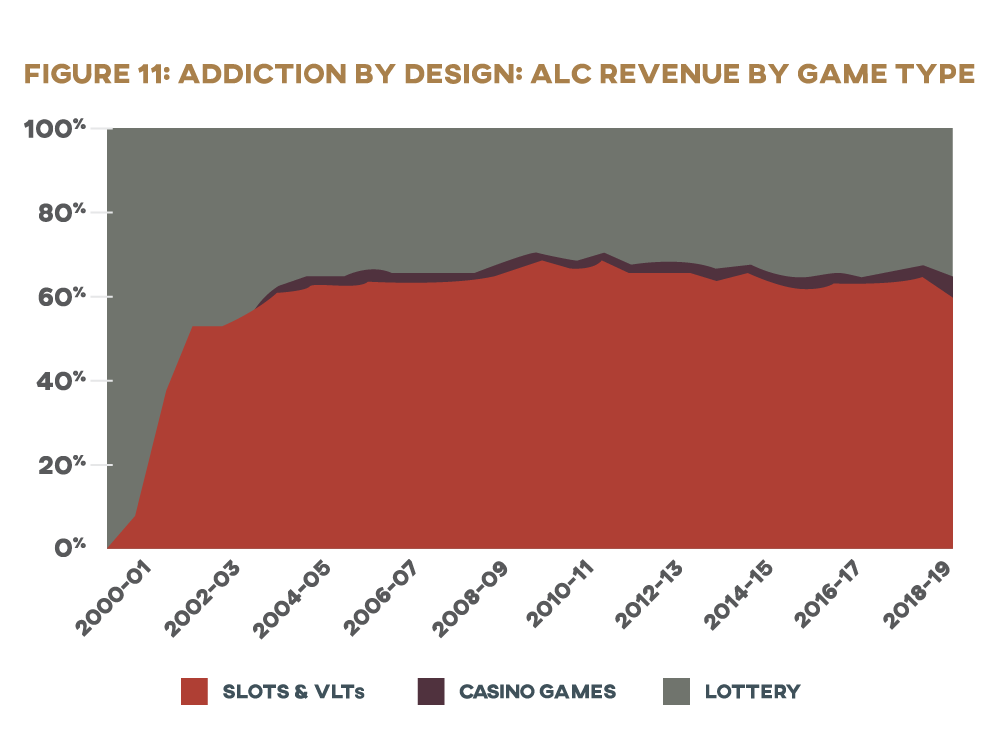

One of the most consistent correlates of problem gambling is game type (Figure 11): those who report gambling on electronic gambling machines (EGMs, usually known as slot machines when found inside casinos, and video lottery terminals, or VLTs, when found in other venues such as pubs and bars) have a much higher risk of problem gambling than do gamblers who report never playing EGMs. One study of gambling in Prince Edward Island, for example, found that a person who played VLTs in the previous year was thirty-eight times more likely to have a significant gambling problem than someone who did not participate in VLT gambling. 25 25 Doiron, “Gambling and Problem Gambling in Prince Edward Island,” iv; see also R. Williams, Y. Belanger, and J. Arthur, “Gambling in Alberta: History, Current Status and Socioeconomic Impacts,” report to the Alberta Gaming Research Institute, April 2, 2011, 105, https://prism.ucalgary.ca/handle/1880/48495.

These machines have faced particular scrutiny for their addictive design.

26

26

N.D. Schüll, Addiction by Design: Machine Gambling in Las Vegas (Princeton: Princeton University Press, 2012), discussed in Matthew Crawford, “Autism as a Design Principle: Gambling,” in The World Beyond Your Head: On Becoming an Individual in an Age of Distraction (New York: Farrar, Straus and Giroux, 2015), 89–112. EGMs have provocatively been described by some researchers as “the crack cocaine of gambling” (N. Dowling, D. Smith, and T. Thomas, “Electronic Gaming Machines: Are They the ‘Crack-Cocaine’ of Gambling?,” Addiction 100 [2005]: 33–45), though Dowling et al. conclude that despite the consistent association in the literature between EGMs and “the highest level of problem gambling,” the empirical evidence available at time of writing was insufficient to definitively “establish the absolute ‘addictive’ potential of EGMs” (42). See also V.V. MacLaren, “Video Lottery Is the Most Harmful Form of Gambling in Canada,” Journal of Gambling Studies 32, no. 2 (June 2016): 459–85; Gambling Research Exchange Ontario, “Slots and VLTs,” https://www.greo.ca/en/topics/slots-and-vlts.aspx; Centre for Addiction and Mental Health, “About Slot Machines,” https://www.problemgambling.ca/gambling-help/gambling-information/about-slot-machines.aspx; J. Rosengren, “How Casinos Enable Gambling Addicts,” The Atlantic, December 2016, https://www.theatlantic.com/magazine/archive/2016/12/losing-it-all/505814/.

EGMs are built with features that impair players’ rational control, such as losses disguised as wins—where audio and visual effects celebrate a player “winning” an amount less than he or she wagered, even though the player lost money—and near misses, where the display of symbols makes it appear that the player was close to winning, even though the outcome of each play is completely random. These structural characteristics manipulate players’ emotional and cognitive perceptions of the game to keep them playing longer and spending more.

27

27

C. Livingstone, “How Electronic Gambling Machines Work,” 2, https://aifs.gov.au/agrc/sites/default/files/publication-documents/1706_argc_dp8_how_electronic_gambling_machines_work.pdf; see also K.A. Harrigan et al., “Research Briefing

Note: Summary of the Effect and Regulation of Electronic Gaming Machine Near Misses and Losses Disguised as Wins (LDWs)

on Players,” Gambling Research Exchange Ontario, August 24, 2016, https://www.greo.ca/Modules/EvidenceCentre/Details/

research-briefing-note-summary-effect-and-regulation-electronic-gaming-machine-near-misses; Harrigan, “Gap Analysis: Structural Characteristics of EGMs as Indirect Risk Factors for Problem Gambling Versus the Gaming Regulations,” Gambling Research Exchange Ontario, https://www.greo.ca/Modules/EvidenceCentre/Details/gap-analysis-structural-characteristics-egms-indirect-risk-factors-problem-gambling-versus-1; C. Jensen et al., “Misinterpreting ‘Winning’ in Multiline Slot Machine Games,” International Gambling Studies 13, no 1 (2012): 112–26, DOI: 10.1080/14459795.2012.717635.

Available data suggest that most of Atlantic Canada’s gambling dollars are collected at the region’s EGMs: over the past four years, around 60 percent of ALC’s net win (revenue after prizes, but before expenses) came from casino slot machines and VLTs. Though data on slot-machine revenue from the Atlantic region’s non-ALC casinos is not publicly available, slots typically generate the overwhelming majority of gaming revenue at other Canadian casinos, 28 28 For example, in every year that the Ontario Lottery and Gaming Corporation (OLG) recorded how much money was generated by slots (2000–2001 through 2010–11) in Ontario, where VLTs are illegal, slot machines generated least 88 percent of casino revenue (Dijkema and Wolfert, Pressing Its Luck). In British Columbia, slot machines have been responsible for an average of 71 percent of casino and community gaming revenue since 2005. The average for all years of available data on slot machines in ALCs Red Shores casinos is also in this range, at 84 percent. meaning that the proportion of net win generated by EGMs in the Atlantic provinces is almost certainly higher when the region’s other casinos are included. 29 29 Author’s calculations based on data from annual reports of ALC and provincial gaming corporations. For detailed calculation methodology, see Dijkema and Wolfert, Pressing Its Luck. If more than half of the Atlantic provinces’ gambling tax is collected by machines designed to override players’ conscious control, can this tax really be called “voluntary”?

Gaming Out a Government Gambling Policy

The Atlantic provincial governments are addicted to gambling. ALC and casino money is treated exactly the same way as general tax revenue—even though this “voluntary tax” is not collected equitably, as the data show. Through the gambling industry, the state is digging deeper into the pockets of those who have least, so that it can keep public programs and services artificially cheap for everyone in the province. How, then, can the government be weaned off this unhealthy and unjust dependency?

Getting Clean: Cold Turkey

We suggest that the massive economic upheaval created by the COVID-19 pandemic and its containment measures represents a unique opportunity for the provincial government to cut its addiction to gambling money cold turkey. At time of writing, the total cost of the outbreak on Atlantic Canada’s finances is impossible to predict, but the $461 million that these provinces stand to lose in gambling income is certain to pale in comparison. The region’s finances will need to be rebuilt after the COVID-19 crisis subsides, and this rebuilding project should include structures preventing the government from depending on ALC profits to pay its bills. Social-distancing measures have already cut off the provinces’ flow of gambling money: casinos and VLT bars have been shut down the same as most others, and the amount of revenue going into public coffers from gambling is likely to be at historic lows.

30

30

Atlantic Lottery Corporation, “An Update to Players from Atlantic Lottery President and CEO Brent Scrimshaw,” March 16, 2020, https://www.alc.ca/content/alc/en/corporate/about-atlantic-lottery/corporate-releases/2020-03-16.html, Kevin Doucette and Giuseppe Valiante, “New Brunswick Declares Emergency, Orders Most Public-Facing Companies Closed,” The Star, March 19, 2020,

https://www.thestar.com/halifax/2020/03/19/two-new-nova-scotia-covid-19-cases-bring-provincial-total-to-14.html; Meghan Groff, “Bars closed, No in-Person Dining and Gatherings Limited to 50, Premier Announces,” Halifax Today, March 17, 2020, https://www.halifaxtoday.ca/local-news/bars-closed-restaurants-take-out-only-and-gatherings-limited-to-50-premier-announces-2174059; Graeme Benjamin, “Coronavirus: P.E.I. Bans in-Room Dining, Bars in Effort to Stop Spread of Virus,” Global News, March 17, 2020, https://globalnews.ca/news/6690257/p-e-i-bans-in-room-dining/; CBC News, “N.L. Orders Bars, Gyms and Other Business to Close Amid Public Health Emergency,” March 18, 2020, https://www.cbc.ca/news/canada/newfoundland-labrador/john-haggie-health-act-covid-19-1.5501264.

The COVID-19 pandemic provides the provinces with an unprecedented opportunity for them to start clean. The costs to the treasury will never be lower. Moving gambling revenue out of each government’s consolidated fund and into a specific fund—preferably aimed at relief of poverty— would be the equivalent of the government admitting it has a problem, admitting that it has harmed the public it is intended to serve, and forming the first steps to making direct amends.

31

31

Gamblers Anonymous, “Recovery Program,” http://www.gamblersanonymous.org/ga/content/recovery-program.

Habit Forming

Once ALC funds have been disentangled from legitimate tax revenue, then, how could they be used to advance the state’s responsibility to administer justice for the most vulnerable? One approach is to redistribute gambling money back to the poor directly. A second strategy is using ALC profits to incentivize saving in accounts geared toward financially fragile households. The economic fallout of the COVID-19 outbreak, involving sudden layoffs on an unprecedented scale, has drawn attention to the importance of assets like emergency savings to cover an unexpected loss of income. 32 32 Many Canadians are asset-poor, making them particularly vulnerable to the loss of income accompanying an unexpected layoff. See J. Robson, “Assets in the New Government of Canada Poverty Dashboard: Measurement Issues and Policy Implications,” presentation to the Canadian Economics Association, May 31, 2019, https://www.dropbox.com/s/4ty0pqay5vkuq7j/Presentation_Robson_CEA2019.pdf?dl=0, https://www.compassworkingcapital.org/why-asset-poverty-matters; McGill Newsroom, “Half of Canadians Don’t Have Enough Savings,” May 11, 2015, https://www.mcgill.ca/newsroom/channels/news/half-canadians-donthave-enough-savings-250447. Yet close to half of Canadians do not have enough to cover their living expenses for three months. 33 33 D. Rothwell and J. Robson, “The Prevalence and Composition of Asset Poverty in Canada: 1999, 2005, and 2012,” International Journal of Social Welfare 27, no. 1 (2018): 17–27; McGill Newsroom, “Half of Canadians Don’t Have Enough Savings,” May 11, 2015, https://www.mcgill.ca/newsroom/channels/news/half-canadians-dont-have-enough-savings-250447; Erica Alini, “Coronavirus: Nearly 1 Million Canadians Applied for EI Last Week,” Global News, March 24, 2020, https://globalnews.ca/news/6726111/coronavirus-ei-claims-1-million/. Why not channel Atlantic Canadians’ desire for the excitement of chance toward activities that help them build up an emergency fund? Prize-linked savings (PLS) products, in which accountholders forgo some or all of the interest they would normally earn on their savings in exchange for the chance to win a prize, have met with notable success in other jurisdictions, from Britain’s national lottery bonds to the “Save to Win” program offered by credit unions across the United States. 34 34 National Savings and Investments, “Premium Bonds,” https://www.nsandi.com/premium-bonds-25?ccd=NQBPAC; Save to Win, “History of Save to Win,” http://www.savetowin.org/product-info/history-of-save-to-win; Michigan Credit Union League, “Save to Win Celebrates 10 Years, $50 Million Saved in First Half of 2019,” July 23, 2019, https://www.mcul.org/News?article_id=29123.

Making Sure the Right House Wins

One of the responsibilities of government is to enable and encourage good habits, including economic ones, and to shape structures that promote the economic well-being of its citizens. It is important to remember that the saturation of our society with gambling fosters in its inhabitants a distinct set of habits, attitudes, and dispositions that have social and economic consequences. Gambling is not the way to financial security, neither for individuals nor for the province. 35 35 L. Dadayan, “State Revenues From Gambling: Short-Term Relief, Long-Term Disappointment,” The Nelson A. Rockefeller Institute of Government, April 2016, https://rockinst.org/issue-area/state-revenues-gambling-short-term-relief-long-term-disappointment/. Contrary to what lottery ads would have us believe, people shouldn’t hope to get something for nothing—nor should the state encourage this insidious get-rich-quick impulse. When the state does its part to advance a positive vision of economic life, it nurtures in its citizens virtues that benefit not just pocketbooks (both private and public) but society as a whole. 36 36 D.N. McCloskey, “Bourgeois Virtues?,” Cato Policy Report, May 18, 2006, https://www.deirdremccloskey.com/articles/bv/cato.php. It’s time for governments to fulfill their responsibility to turn bad habits into good.