Table of Contents

Table of Contents

Memorandum

MEMORANDUM

TO: Niagara Region Council Members

Office of the Regional Clerk, Niagara Region

FROM: Andreae Sennyah, Director of Policy, Cardus

Brian Dijkema, Vice President of External Affairs, Cardus

DATE: June 27, 2022

SUBJECT: Niagara Regional Council Should Retain Exemption from Development Charges for Places of Worship

WHO WE ARE

Cardus is a non-partisan think tank dedicated to clarifying and strengthening, through research and dialogue, the ways in which society’s institutions can work together for the common good.

Issue

The Niagara Region Council is planning to remove the exemption from developmental charges (D.C.) for places of worship under By-law 2017-98. 1 1 Niagara Region, “BY-LAW NO. 2017-98 A BY-LAW TO ESTABLISH DEVELOPMENT CHARGES FOR THE REGIONAL MUNICIPALITY OF NIAGARA AND REPEAL BY-LAW 2017-68,” 2017, https://www.niagararegion.ca/government/bylaws/pdf/2017/By-law-No-2017-98.pdf. See Section 11. The current by-law exempts from development charges “that portion of a place of worship which is used exclusively as a place of worship for religious services and any reception and meeting areas used in connection with, or integral to the worship space.” The new proposed D.C. by-law contains no such exemption. 2 2 Watson & Associates Economists Ltd., “Development Charges Background Study: Regional Municipality of Niagara - Accessible Report,” May 30, 2022, https://niagararegion.ca/business/property/pdf/2022-dc-background-study.pdf. See Appendix I.

Recommendation

The Niagara Region Council should maintain the current discretionary exemption for places of worship in the by-law for the following reasons:

- Every comparable jurisdiction provides some form of exemption for places of worship. By removing the exemption, Niagara Region would be out of step with other jurisdictions.

- Religious communities make an outsized contribution to the common good. Their total contribution (approximately $141 million) more than offsets the lost revenue that comes from these exemptions for their places of worship.

- The financial gain of removing the exemption is miniscule. Based on the available data, of the $31 million spent on mandatory and/or discretionary exemptions in the past seven years, only 1.2% was spent for places of worship.

- Retaining the exemption provides predictability to religious communities as they plan their (re)developments. It also removes the risk of politicization that comes with choosing winners or losers through a granting program.

Background

- Jurisdictional Comparison of Exemptions

The purpose of development charges is to help offset the capital costs that increase as a consequence of a new development or redevelopment. These capital costs serve the increased demands on municipal services such as policing and emergency services, healthcare, water, wastewater, and other services.

Useful comparisons to the development charge exemption are federal and provincial tax exemptions for places of worship and religious organizations. Under the federal Income Tax Act, registered religious charities are exempt from paying income tax. For the federal government, a permitted charitable purpose for religious charities includes “establishing and maintaining buildings for religious worship and other religious use”. 3 3 Government of Canada, “Advancement of religion,” April 20, 2018, https://www.canada.ca/en/revenue-agency/services/charities-giving/charities/registering-charitable-qualified-donee-status/applying-charitable-registration/charitable-purposes/advancement-religion.html. Provincially, Ontario’s Assessment Act (s. 3) exempts religious organizations from property taxes on land that is used in connection with worship.

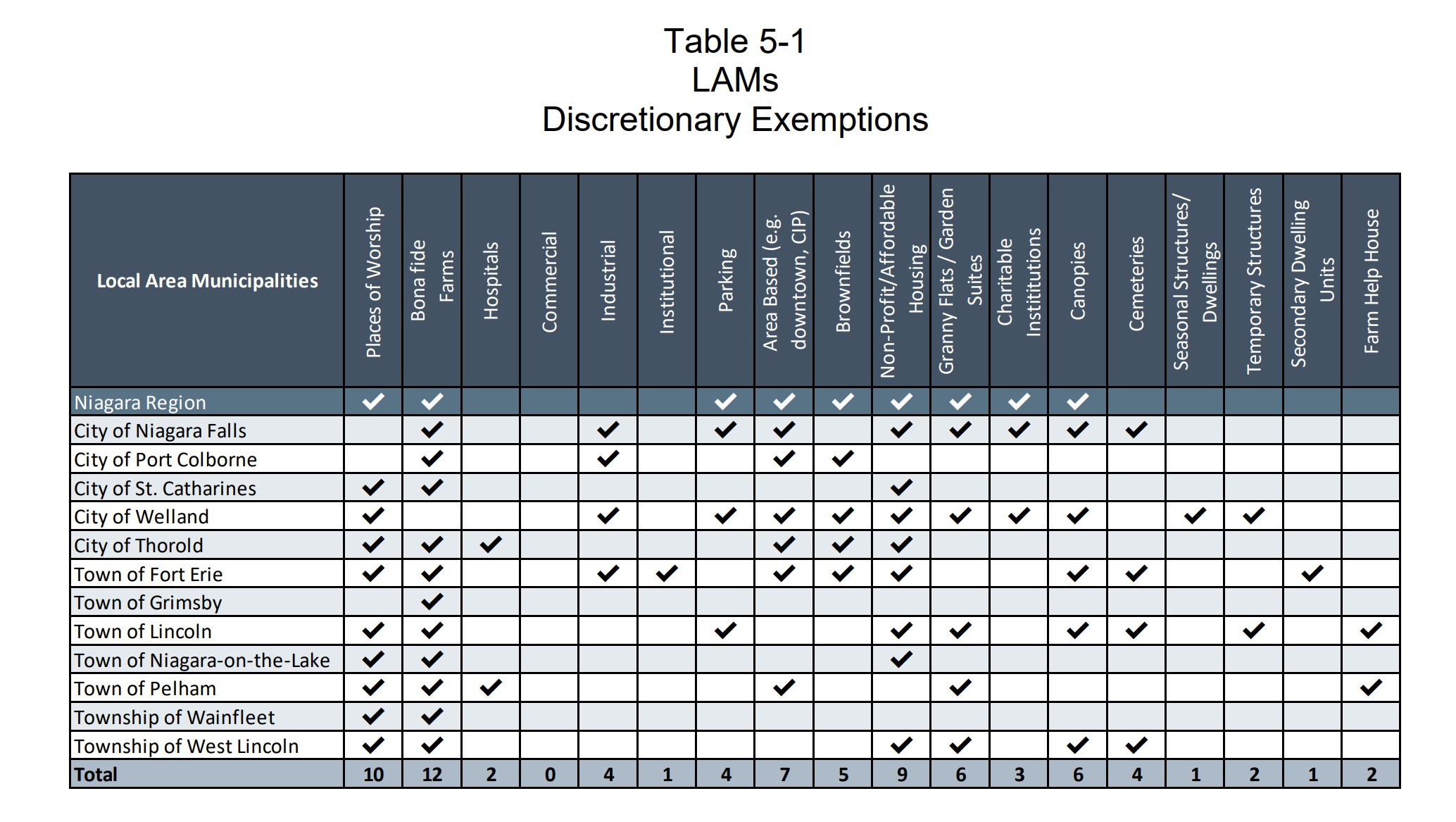

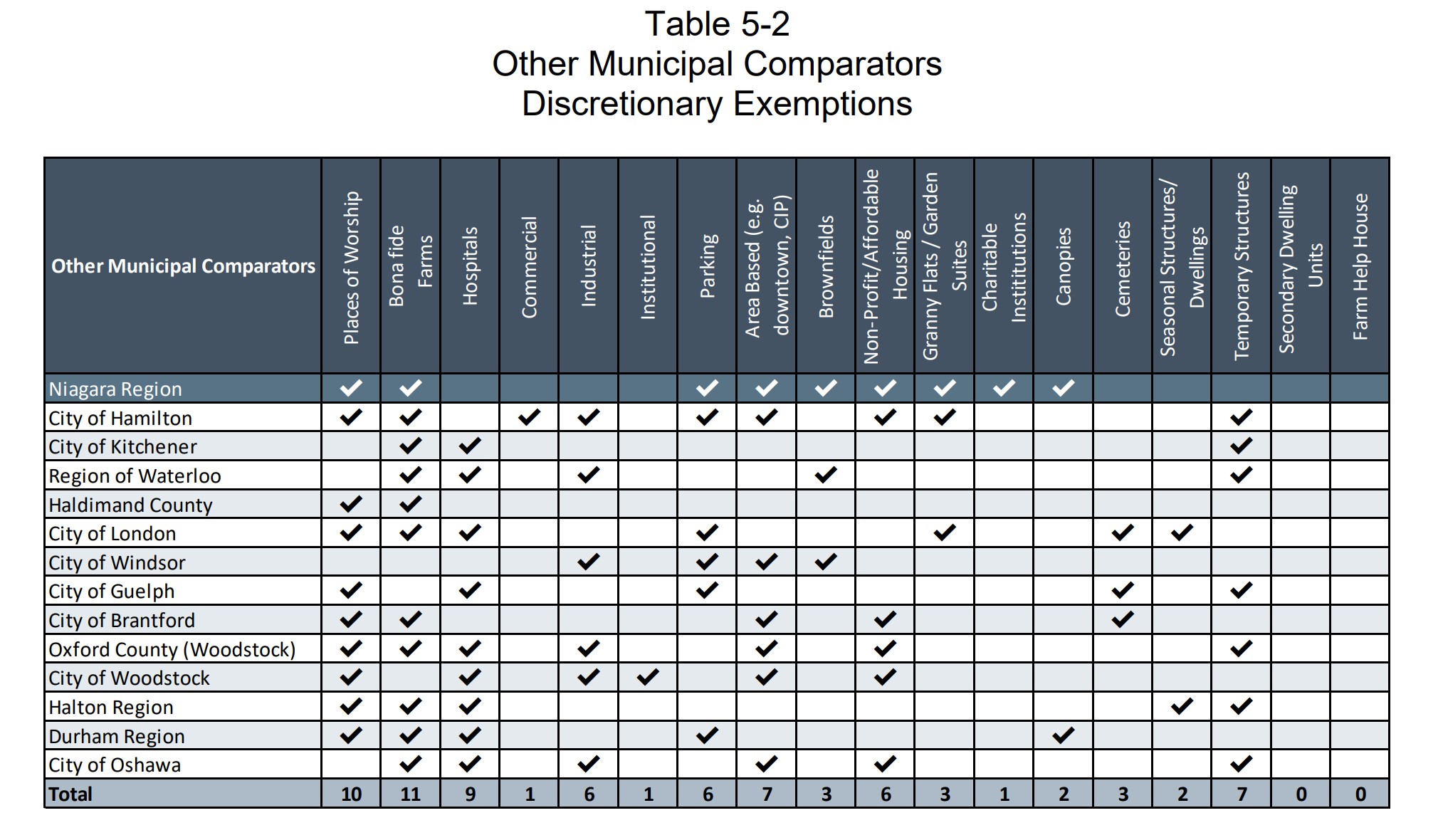

At the municipal level, the tables below from the Watson and Associates 2022 Development Charge Policy Report show that nine of twelve constituent municipalities within the Niagara Region already have discretionary exemptions for places of worship. Looking beyond the Region, nine of the thirteen other comparable Ontario municipalities also have exemptions for places of worship. 4 4 Watson & Associates Economists Ltd., “2022 Development Charge Policy Report Niagara Region,” May 19, 2022, https://www.niagararegion.ca/business/property/pdf/2022-dc-policy-report.pdf. See p. 5-4. Removing the current exemption for places of worship would put Niagara Regional Council out of step with approaches of the provincial and federal governments, their own member municipalities, and other comparable municipalities.

2. Outsized Public Benefit

The approaches of other jurisdictions noted above recognizes the reality that religious organizations provide a public benefit. In fact, the federal income tax exemption for religious charitable organizations requires these groups to meet a public benefit test before qualifying. 5 5 Government of Canada, “Guidelines for registering a charity: meeting the public benefit test,” January 23, 2019, https://www.canada.ca/en/revenue-agency/services/charities-giving/charities/policies-guidance/policy-statement-024-guidelines-registering-a-charity-meeting-public-benefit-test.html#toc3. See Section 3.0 The test for public benefit. Available data from March 2018 shows that 33,020 religious charities in Canada met the federal test. The Religious charitable category also contained the largest number of charities compared to other categories. 6 6 Government of Canada, “Charities program facts and figures,” December 4, 2018, https://www.canada.ca/en/revenue-agency/services/charities-giving/charities-media-kit/charities-program-facts-figures.html. Looking at the charitable sector as a whole (which includes religious charities), Canada Helps reports that 11% of Canadians are dependent on charities to meet their basic needs including food and shelter. Charities spend 90% of their funds on programs and services, and the majority (58%) are run entirely by volunteers. 7 7 Canada Helps, “2022 The Giving Report,” 2022, https://www.canadahelps.org/en/the-giving-report/meet-the-sector/.

Cardus has conducted research (the Halo Project 8 8 Cardus, The Halo Project, https://haloproject.ca/. ) to measure the socio-economic benefit that a religious congregation contributes to its local community. The value matrix quantifies a congregation’s economic contribution according to 41 variables grouped into seven broad areas:

- open space (e.g., recreational use)

- direct spending

- educational programs (e.g., a daycare on site)

- magnet effect (e.g., spending by visitors attending weddings, funerals, etc.)

- individual impact (e.g., helping immigrant and refugee families settle in Canada; marriage and family counseling)

- community development (e.g., job-training, housing initiatives)

- social capital and care (e.g., programs that benefit people in the surrounding community, volunteer activities, food banks)

Places of worship are not commercial institutions and do not generate a profit. Their outsized contributions to the common good are more than offset by the lost revenue that comes from these exemptions. According to the Halo Project calculations, for every $1.00 in a religious congregation’s annual budget, a city gets an estimated $3.39 of benefits. Based on the available data, the total Halo Effect for municipalities in the Niagara Region is $141 million.

| Municipality | Total Benefit |

| Fort Erie | $ 442,881 |

| Grimsby | $ 19,920,000 |

| Lincoln | $ 4,460,000 |

| Niagara Falls | $ 23,540,000 |

| Niagara-on-the-Lake | $ 0 |

| Pelham | $ 8,270,000 |

| Port Colborne | $ 5,190,000 |

| St. Catharines | $ 59,540,000 |

| Thorold | $ 6,100,000 |

| Wainfleet | $ 0 |

| Welland | $ 13,120,000 |

| West Lincoln | N/A |

| TOTAL | $ 140,582,881 |

3. Minimal Financial Impact

The lost (deferred) revenue of Niagara Region’s exemption for places of worship is a tiny fraction of the total spending on exemptions. Based on the available data, of the $31 million spent on discretionary and/or mandatory exemptions in the past seven years, only 1.2% was spent on places of worship.

This data show that the exemption for religious buildings is concentrated and sporadic. This means that removing the discretionary exemption for places of worship from the by-law will have a negligible impact on the Region’s finances on an annualized basis. However, the cost savings to a local place of worship (e.g. $384,000) would be significant for those congregants. This is especially true when considering that religious congregants bear the cost of financing new builds or redevelopments, often for years after the building is completed.

The takeaway is this: the cost of discretionary exemptions for places of worship are insubstantial for the Region’s balance sheet, but are a major additional cost on religious communities’ balance sheets. And that cost will have disproportionate, negative effects on the most vulnerable in your Region.

4. Retain Existing Structure and Neutrality

The Watson and Associates 2022 Development Charge Policy Report states that an “alternate approach to an exemption is to provide a grant program outside of the D.C. by-law.” 15 15 Watson & Associates Economists Ltd., “2022 Development Charge Policy Report Niagara Region.” See p. 5-2 to 5-3. This suggests that if a discretionary exemption is removed for places of worship, Council could introduce a targeted grant program instead. Elsewhere, the Region notes that, “The majority of the grant programs…are not application based, meaning that they are automatic reductions that are available to a developer as long as they meet the definition of each development type.” 16 16 Niagara Region, “Regional Development Charges Grants and Exemptions Summary,” May 8, 2019. See p. 4. Given that the institutional structures for administering this exemption already exist, it would be duplicative and cost-intensive for the Region to create a granting program that is effectively identical.

Further, the default provision of an exemption to places of worship accomplishes two other goals. First, it provides stability and predictability to faith communities as they plan new capital projects. Communities can move ahead to meet new or growing needs without worrying about, or expending limited resources on grant applications. For members of Council, the default exemption de-politicizes the process. Members are not forced to choose between various faith communities (ex. exempting this mosque over that church), effectively picking winners and losers. Removing the standing exemption, with the intention of introducing a grant risks politicizing the exemption program and perpetuating inequities for minority religious communities.

Recommendation: Niagara Region Council should maintain the development charge exemption in the by-law for places of worship

Further Questions for Council

- What is Council’s rationale for removing the discretionary exemption for places of worship?

- Were religious communities consulted during the community engagement phase?

- If yes, how many were consulted and what faith communities did they represent? Were there representatives from all twelve municipalities? What opportunities were they given to present and is their feedback publicly available?