Table of Contents

Table of Contents

Summary

This report summarizes the first documented quantitative national estimates of the economic value of religion to Canadian society, using similar metrics as used in similar studies of US society (Grim and Grim 2016; 2019) and of faith congregations in Toronto (Daly 2016). The study provides conservative, mid-range, and high estimates.

The study’s most conservative and beginning-point estimate, which takes into account only the revenues of faith-based organizations, is more than $30 billion CAD annually. While this first estimate has the most concrete data, we believe that it is certainly an undervaluation because it focuses on annual revenues rather than on the fair-market value of the goods and services that religious organizations provide.

Our second, mid-range estimate corrects for this in three ways: by providing an estimate of the fair-market value of goods and services provided by religious organizations and charities, by including faith-related food businesses, and by including a valuation of the substance-abuse recovery support groups hosted by congregations. This mid-range estimate puts the value of religion to Canadian society at more than $67 billion annually. By way of comparison, this would make religion the country’s ninth-largest enterprise, just behind TC Energy and ahead of Bank of Montreal (Disfold 2020). Or in terms of national economies, it would make Canadian religion the world’s seventy-second-largest economy, putting it ahead of more than 110 countries (World Bank 2019).

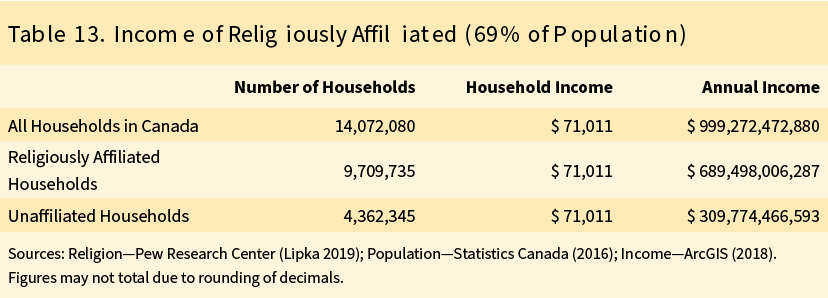

Our third, higher-end estimate recognizes that people of faith conduct their affairs to some extent (however imperfectly) inspired and guided by their faith ideals. This higher-end estimate is based on the household incomes of religiously affiliated Canadians and places the value of faith to Canadian society at nearly $690 billion annually.

Introduction

Religion is an active force in the public, professional, and personal lives of many in Canada. Safeguards for religious freedom—including constitutional protection of freedom of conscience and religion as a fundamental right—help to ensure a dynamic religious marketplace, including the ability of each person to have a religion, change religions, or have no religion at all.

A solid body of research has explored the social contributions of religion, which range from increasing civic participation to ministering to spiritual, physical, emotional, economic, and other life needs (Daly 2016; Friesen 2017a; 2017b; 2017c; Grim and Grim 2016; 2019; Picarello et al. 2016). Some studies have looked at the social benefits of congregations (Ammerman 2001; Cnaan et al. 1999; Chaves 1999), including some that have attempted to quantify the social and volunteering benefits that congregations provide to communities (Tirrito and Cascio 2003). Other studies have looked at the role of local religious groups in promoting education and civic engagement (e.g., Regnerus 2001; Muller and Ellison 2001). Studies have also considered how religious participation and programs help decrease crime and deviance (Bainbridge 1989; Hummer et al. 1999; Lester 1987) or promote mental health (Grim and Grim 2019; Johnson et al. 2002; Koenig et al. 2011; Koenig and McConnell 1999; Fagan 2006). And yet other studies have looked at how involvement in organized religion improves government stability and economic growth, with the primary mechanism being increased social capital and positive civic networks provided through congregational activities (Putnam 2000; Fukuyama 2001; Schwadel 2002; Zak and Knack 2001).

A recent report to Canada’s Special Senate Committee on the Charitable Sector on the impact of the religious charitable sub-sector in Canada (Pellowe 2018) identified four ways that Canadian registered charities that advance religion provide public benefit:

- Religion develops and activates prosocial attitudes and behaviours, resulting in high levels of generosity and volunteerism that benefit both religious and secular charities, and improves public civility.

- Religion results in better personal outcomes that reduce demand on the state’s resources for rehabilitation and health care and improves quality of life and individual contribution to society.

- Religion has tangible community benefits in terms of social capital, infrastructure, and neighbourhood viability, and a twelve-times return on investment related to tax concessions.

- Religion creates tangible benefits for the public at large based on a core of people who are other-centred, civically engaged, and willing to work together sacrificially for the common good.

Of course, not every religious organization or group has the same level of impact, and not all of the impact is positive. Indeed, there are high-profile cases where people in religious authority or acting in the name of religion have engaged in destructive activities. These negative effects include such things as the abuse of children by some clergy (Barrera and Fortune 2019; Cafardi 2008), cases of fraud (Ramlakhan 2019; De Sanctis 2015), and places of worship becoming recruitment sites for violent extremism (Heroux and Baksh 2017; Neumann 2008), all of which detract from the other positive values of religious institutions. Such serious ills affect a wide variety of institutions, including major public universities (Schwartz 2018; Moushey and Dvorchak 2013), publicly traded companies (Canadian Fraud News 2019; Gitlow 2005), and online public chatrooms (Carranco and Milton 2019; Erelle 2015). And, while negative news makes news, both the positive and the negative effects are important and should be clearly understood.

A range of studies provide nuanced analyses of the community impact of congregations. In their study of fifteen congregations in the Chicago area—including Catholic parishes, Protestant churches, Jewish synagogues, Muslim mosques, and a Hindu temple—Numrich and Wedam (2015) concluded that religion has a significant role in shaping postindustrial cities, although the impact varies from congregation to congregation. They also provide a helpful framework for analysis of the different types and levels of impact.

In a separate quantitative study on the effect of shutting down a congregation in an inner city, Kinney and Combs (2015) found that this precedes and contributes to the socioeconomic collapse of the community in which the congregation was located. Specifically, this study found that declines in neighbourhood viability were significantly related to the closure of congregations characterized by bridging social capital—that is, congregations that connected heterogeneous groups and bridged diversity.

Daly (2016) reports on the Halo Project, which conducted a valuation of Toronto’s faith congregations. The study concluded that local congregations are critical economic catalysts, serving as economic engines that support local economies and contribute to the common good of all. The study found that the combined economic impact of the ten Toronto congregations studied was approximately $45 million annually.

1

1

Toronto congregations included in the Halo Project valuation study were Portico (Pentecostal), University Presbyterian Church, Taric Islamic Centre, St. Andrew’s United Church, Masjid Islamic Centre, All Saints Parish and Community Centre

(Anglican), Flemingdon Park Ministries (Anglican), Woodbine Heights Baptist Church, Metropolitan Community Church, and Kingston Road United Church.

Understanding the socioeconomic value of religion to Canadian society is especially important in the present era characterized by disaffiliation from organized religion. The Pew Research Center’s “5 Facts about Religion in Canada” (Lipka 2019), for instance, reports that a declining share of Canadians identify as Christians, while an increasing share say they have no religion. The most recent Pew Research survey in Canada, conducted in 2018, found that 69 percent of Canadians report a religious affiliation, with just over half of Canadian adults (55%) saying they are Christian. Another 29 percent of Canadians say they are either atheist (8%), agnostic (5%), or “nothing in particular” (16%). The Pew study also notes that Canadian census data show that the share of Canadians in this “religiously unaffiliated” category rose from 4 percent in 1971 to 24 percent in 2011, while Pew’s 2018 poll found that an increasing share (8%) identify as Muslim, Hindu, Sikh, Jew, or Buddhist.

At the same time, the 2018 Pew survey found that 64 percent of Canadian adults say religion has a less important role in their country than it did twenty years ago, while only 12 percent say religion has become more important in Canadian society. Pew also found that there is no consensus on whether this is good or bad: “37% of Canadians favour a more important role for religion, while 29% disagree and oppose any more influence for religion in public life, while about 20% have no preference either way.”

Given the division of opinion on religion’s contribution to Canadian society, this present study seeks to shed light on the topic by making an estimate of religion’s socioeconomic value to society. Indeed, we should know if the decline in religion is likely to have negative economic consequences.

In what follows, we provide three estimates of the economic value of faith to Canadian society. Of course, faith has much more value than is represented by a dollar estimate, but such a valuation provides a new way of understanding the contribution of faith to Canadian society. The most conservative estimate takes into account only the revenues of faith-based organizations falling into several sectors: education, health care, local congregational activities, charities, and media. Our second estimate takes into account these revenues but then adds in data-driven estimates of the fair-market value of congregational social services, including substance-abuse recovery support, as well as a valuation of other religious charities and faith-based food businesses (kosher and halal). Then third, we provide a higherend estimate based on the annual household incomes of Canada’s religiously affiliated population.

Estimate 1

Revenues of Faith-Based Organizations

This study’s conservative estimate of the value of the religious sector to the Canadian economy is based primarily on the revenues of religious organizations. We specifically look at the revenues of several main religion sectors: educational institutions, health-care providers, congregations, media, and other charities. For this economic valuation, we use the most recent year of data available.

Educational Institutions

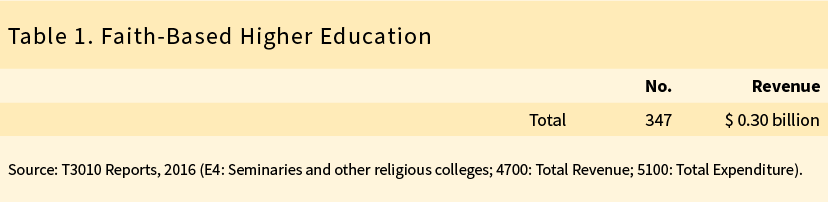

Higher Education. Reported revenue for the 347 Canadian seminaries and other religious colleges from the 2016 T3010 Registered Charity Information Returns totals nearly $300 million, 2 2 All figures are in Canadian dollars. summarized in table 1.

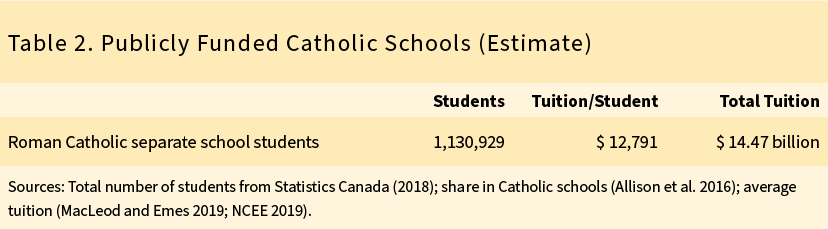

Elementary and High School Education. Taking 2016/2017 as our base year, of the 5,117,328 students in Canada’s public elementary and secondary schools (Statistics Canada 2018), an estimated 1,130,929 (22.1%) attend publicly funded Roman Catholic separate schools (see Allison et al. 2016). Taking the average cost per student of $12,791 (MacLeod and Emes 2019) to be the same for Catholic and non-Catholic public schools (NCEE 2019), we estimate the total economic contribution to be nearly $14.5 billion, as shown in table 2. Although supported with government funds, this represents their economic contribution to Canadian society. They are part of the socioeconomic fabric of Canadian society, preparing generation after generation of young people to enter the workforce or go on for more education.

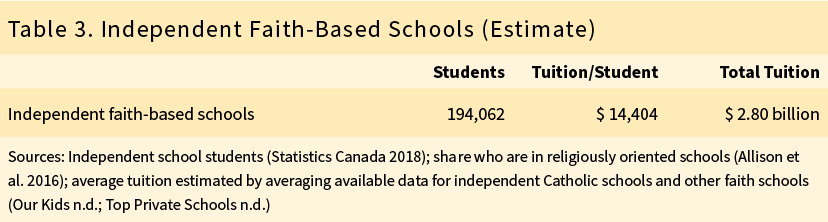

Allison et al. (2016) also found that nearly half (48.3%) of Canada’s 401,784 independent school students (Statistics Canada 2018) attend schools with a religious orientation, which we estimate to be 194,062 students. 3 3 Of these, Allison et al. (2016) found that 45.2 percent attended non-Catholic Christian schools, 31.6 percent independent Catholic schools, 10.8 percent Jewish schools, 9.1 Islamic schools, and 3.3 percent attended schools defined by other religions. We estimate the average tuition to be $14,404 for the approximately 2,000 independent schools, by averaging available data for independent Catholic schools and other faith schools, as shown in table 3.

Note that any revenues from congregational education programs such as vocational training and preschools are not counted here but are included in the valuation for congregations (see chart 1).

Health-Care Providers

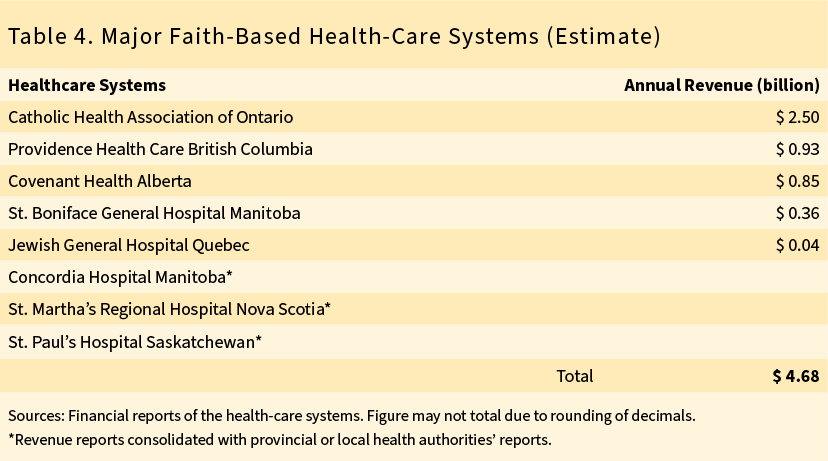

We estimate the value of religiously affiliated health care to Canadian society by adding up the actual annual revenue reported by the largest faith-based health-care networks in the country. Only hospitals and health systems with an active religious affiliation (not just in name) are included, based on their self-descriptions. Revenues totaling $4.68 billion were obtained from the reports of the individual health organizations, as shown in table 4.

This is a very conservative estimate of religion’s contribution to health care in Canada because health care throughout the country was pioneered by faith communities, as is evidenced by the religious names of many hospitals, including the vast majority in Quebec, which were transferred from the Catholic Church to government control in the 1960s (Seljak 1996).

Congregations

The World Christian Database (Johnson and Zurlo 2019) estimates that Canada had 28,107 Christian congregations in 2015, as shown in table 5. This database does not, however, provide an estimate of the number of congregations associated with other religions.

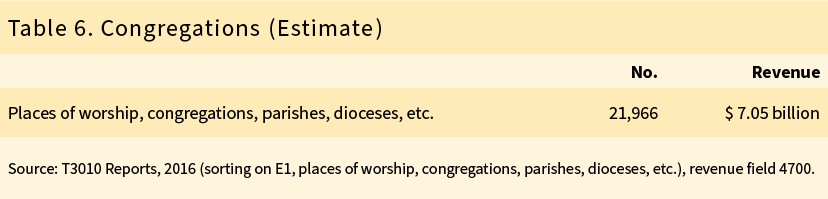

The World Christian Database (WCD) suggests a larger number of congregations than are included in the Canada Revenue Agency’s T3010 report, which is generated from a form that all registered charities in Canada must complete. Our analysis of the most recent T3010 available finds that there are 21,966 charities listed as congregations or places of worship, which is 6,141 fewer than the WCD estimate of 28,107. The difference is in part attributable to the way the T3010 categorizes various religious organizations, such as missionary organizations (i.e., category E2 in the T3010) as a different category than congregations, even though the organization might have within it a house of worship. Also, the WCD includes chapels that might be operating as a missionary outreach of another congregation that handles the financial reporting.

To be conservative in our estimate of the finances of Canadian congregations, we use only data from the congregations that completed the 2016 T3010 Registered Charity Information Returns and do not extrapolate finances from the unregistered or unreported congregations. The T3010 include detailed financial data on 21,966 reporting faith congregations and places of worship. In the most recent year of data available, our analysis finds that Canada’s congregations of all denominations and religions, from Adventists to Zoroastrians, together had about $7 billion in revenue.

Media

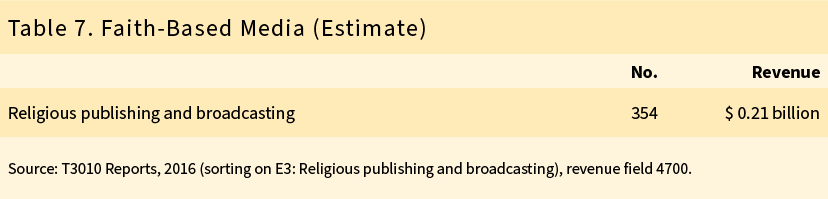

There are 354 religious charities in Canada whose primary work is in publishing and broadcasting. In the most recent year of T3010 data available, our analysis finds that Canada’s faith-based media had about $0.21 billion in revenue, as shown in table 7.

Other Charities

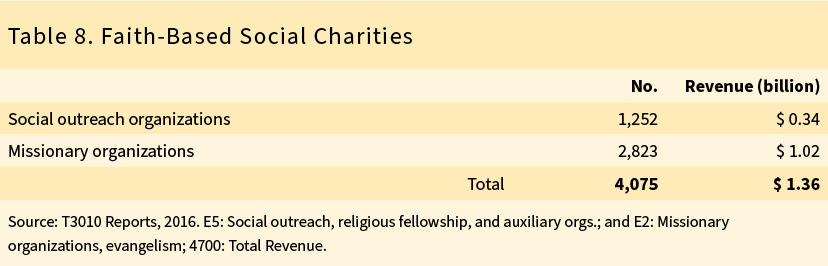

There are more than 4,000 religious charities carrying out the work of faith traditions in Canada. Religious charities are among some of the top-rated Canadian charities. Number three on the MoneySense top-one-hundred list (Brownell 2018) is Emergency Relief and Development Overseas (ERDO), a Christian organization that responds to the practical needs of people living with poverty or crisis around the world.

Charities from other faiths are also among the top-rated. Islamic Relief-IR Canada conducts programs to alleviate hunger, poverty, and suffering. Islamic Relief-IR Canada works independently and in partnership with Islamic Relief Worldwide and other local and international partners to fund ongoing programs.

Some of the top charities on the list, while not explicitly religious, were born as a result of religious groups working together. For example, the top-rated Calgary Food Bank began when several faith leaders realized that their separate efforts of collecting and distributing food to those in need would be more effective if they worked together. It grew from a small not-forprofit in 1982, run by four volunteers in a church basement, into a million-dollar charitable organization with nine thousand volunteers (Calgary Food Bank n.d.).

The T3010 includes detailed financial data on 1,252 religious charities engaged in social outreach and another 2,823 Canadian missionary organizations, many of which are also involved in charitable endeavors. In the most recent year of data available, our analysis finds that Canada’s faith-based social charities together had about $1.36 billion in revenue, as shown in table 8.

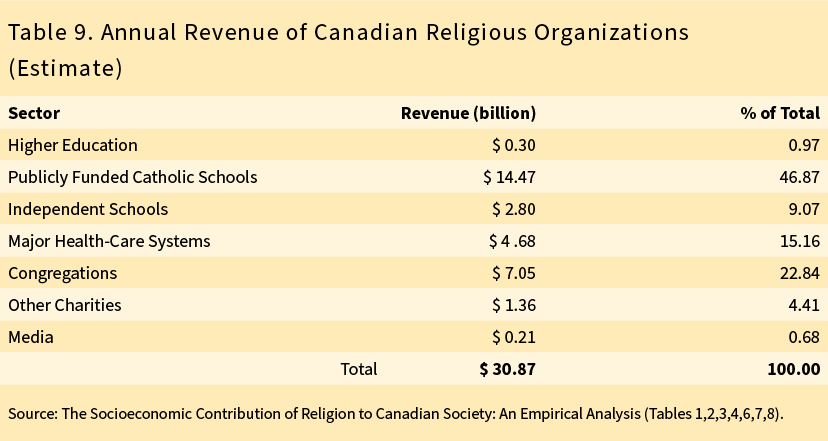

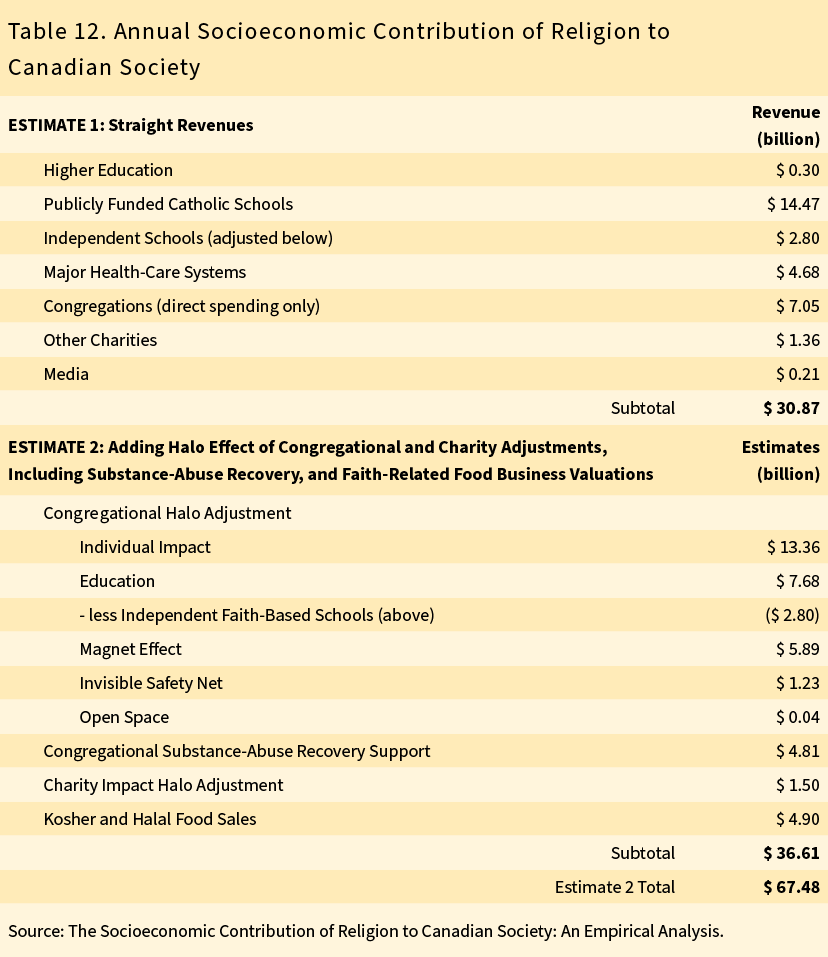

After summing the categories described above, this conservative Estimate 1 puts the economic contribution of the religion sector to Canadian society at $30.87 billion annually. As shown in table 9, this falls into several main sectors: publicly funded Catholic schools ($14.47), congregations ($7.05), major health-care systems ($4.68), independent schools ($2.80), other charities ($1.36), higher education ($0.30), and media ($0.21).

Estimate 2

Adding in a Valuation of the Halo Effects of Congregational Social Services Including Substance-Abuse Recovery Support, and Faith-Related Food Business

In this section, we will expand the first estimate to include an economic valuation of the services provided by local congregations, the broader impact of faith-based charity work beyond its direct finances, the economic activities of faith-related food businesses, and the economic value of congregation-based substance-abuse recovery support groups.

Halo Effect A: Valuation of Congregational Social Impact

Cnaan et al. (1999), Cnaan et al. (2006), Cnaan et al. (2013), Cnaan (2015), Daly (2016), and Grim and Grim (2016; 2019) put dollar amounts on the positive social impact that religious congregations have on communities, as elaborated below. This is generally referred to as the halo effect of having the stable, attractive force of a congregation in a community. These studies catalogue specific ways that congregations provide value to the communities in which they are located.

First, congregations provide support to individuals, couples, and families. These include activities that (1) promote health and well-being, (2) mitigate negative costs such as legal troubles or lost productivity, (3) increase benefits to the local communities, including employment, which also includes paying employment taxes, and (4) investment in family and children. Such activities are associated with decreased drug and alcohol abuse, divorce, domestic violence, and other personal problems.

Second, a congregation’s direct spending contributes to the local economy through buying goods and services, employing local residents, and using local vendors.

Third, congregations have a “magnet effect” that pulls people and economic activity into the community, including hosting weddings, funerals, artistic performances, and other events such as lectures, all of which can draw out-of-town visitors. These magnet effects are tangible activities such as visitors spending money at local restaurants and other small businesses.

Fourth, there are daycare centres and other educational activities associated with congregations.

Fifth, congregations provide “open space”—that is, a congregation’s outdoor space often provides a garden and other features that contribute not only to increasing community aesthetics and lowering stormwater runoff treatment costs but also to recreational and leisure possibilities.

Sixth, congregations provide an invisible safety net, including the volunteer and in-kind support that augments a city’s network of social services. In Canada, one significant type of safety net provided by congregations is their outreach to and provisions for immigrants. Of the roughly 250,000 immigrants that Canada receives each year, most settle in Canada’s largest cities, where congregations meet specific needs that extend beyond the capacities of government agencies (Reimer et al. 2016). And in smaller cities and non-urban areas, congregations provide a wide range of services because few government supports are available. Congregations also provide for the needs of immigrants by adapting to specific niche demands and by filling in gaps left by other service providers (Reimer et al. 2016). As an example of filling niches, the United Church of Canada has a special program to sponsor LGBTIQ2+ refugees. Canada is one of only a few countries in the world with an LGBTIQ2+ refugee program (United Church n.d.).

Many of the social services provided by congregations are possible because they have facilities to operate in and from. However, of the twenty-seven thousand faith buildings in Canada, 30 percent are projected to close in the next ten years (Pajot 2020; Allen 2019). 4 4 In private correspondence with National Trust for Canada regeneration project leader Robert Pajot, the primary researcher behind these figures, the estimate that one-third of the twenty-seven thousand faith buildings in Canada are projected to close in the next ten years is based on some solid groundwork but not one specific study. There is no official source of information for the total number of faith buildings in Canada, but a report from Natural Resources Canada (2013) on energy efficiency of buildings provided an estimate, which according to Pajot was derived from Statistics Canada’s Business Register of religious organizations, from which statisticians then developed a weighted calculation that permitted them to derive the number of buildings. The estimated closure rate came from information that Pajot gathered over the years from many sources: including denominational reports, consultants for faith properties, and heritage organizations and media reports. Along with researchers at Faith and the Common Good, the National Trust for Canada concluded that 30 percent was a reasonable (if somewhat conservative) estimate for a national average. In some regions, Pajot reports that over 50 percent of faith buildings were slated for closure, in others it was less, so the 30 percent reflects an informed guess. Pajot notes that those estimates are now four years old, and the current pandemic crisis will likely accelerate the permanent closure of many faith buildings.

Though a congregation is more than its building, the buildings are more than just places for congregations to worship, and their loss will affect society in general, because these buildings are also used by many organizations in addition to the religious congregation itself. A new study by the Ontario Trillium Foundation and Partnership Network (2020) examines how many not-for-profits and community groups would be left without a place to gather if the religious building they are using were to close. More than 50 percent of the survey’s respondents stated that they would not be able to find another space to use for free or at an affordable cost.

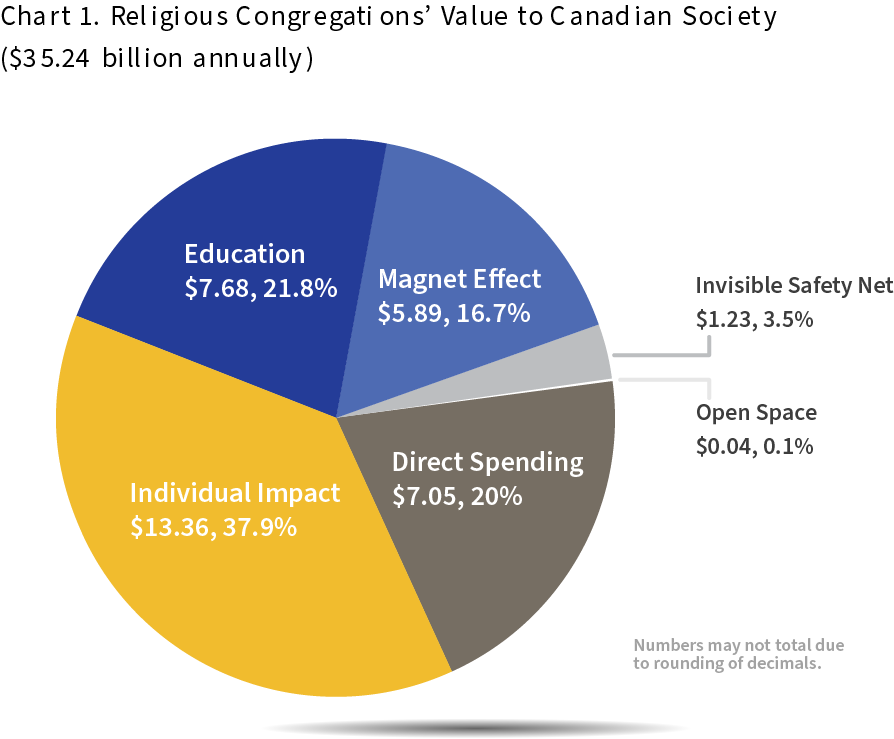

Taking account of these various values that congregations provide to communities, the Cnaan et al. studies and Grim and Grim (2016) estimate the average distribution of the value as follows:

- Direct spending (20%)

- Individual impact (37.9%)

- Education (21.8%)

- Magnet effect (16.7%)

- Invisible safety net (3.5%)

- Open space (0.1%)

Applying the above findings to a national estimate, we begin by taking the cash revenues of congregations as a conservative equivalent of the direct spending of congregations, as Daly (2016) did for Toronto. This is appropriate because, as the norm, congregations pretty much spend what comes in. 5 5 See “Shining a Light on How Churches Spend Money,” Christianity Today, September 2019, https://www.churchlawandtax.com/web/2019/september/shining-light-on-how-churches-spend-money.html. We therefore take $7.05 billion ($7,048,839,678) from table 6 as the amount of direct spending of Canadian congregations nationwide, which we assume based on the algorithm above to be 20 percent of the total value of congregational activities. From that we then allot the other 80 percent proportionally (as shown in chart 1): individual impact $13.36 billion (37.9%), education $7.68 billion (21.8%), magnet effect $5.89 billion (16.7%), invisible safety net $1.23 billion (3.5%), open space $0.04 billion (0.1%), with a total of $35.24 billion. Using this approach, we come up with a more realistic value of the multifaceted services provided by congregations, including education ranging from preschool and schools, to seminars and conferences, to job and marriage courses.

Congregational Substance-Abuse Recovery Support Valuation

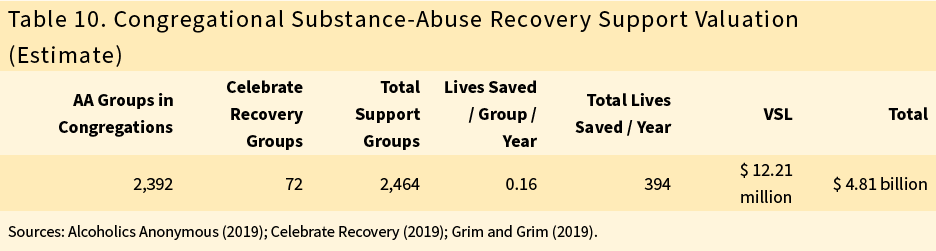

Our study adds an additional category of impact not included in the previous congregational valuations by Grim and Grim (2016), Cnaan (2015), and Daly (2016). Grim and Grim (2019) found that it is especially important to take into account the value of lives saved through recovery support programs hosted in local congregations, such as Alcoholics Anonymous (AA) and Celebrate Recovery.

Grim and Grim (2019) found that each Alcoholics Anonymous and/or Celebrate Recovery support-group meeting in a church was responsible for saving 0.16 lives annually. Our analysis of AA finds that on average, nearly half (47%) of all AA groups in Canada meet in churches or other religious congregation meeting places. For example, of the 466 AA meetings in the Toronto area, 332 (71%) meet in churches (Greater Toronto Area Intergroup n.d.), and our analysis finds that varying percentages meet in churches in other parts of Canada (e.g., Vancouver 37%, Quebec City 39%, St. John’s 44%, and Halifax 45%). Overall, AA reports 5,091 groups with 84,891 members in Canada (Alcoholics Anonymous 2019). If 47 percent of those are in houses of worship, that would be 2,392. In addition, there are 72 Celebrate Recovery groups meeting in churches across Canada, bringing the total to 2,464. And if 0.16 lives are saved per group per year, that would be 394 lives saved annually. This estimation may seem by some as overly conservative, especially because a common story of AA members is that, were it not for AA, they would be in jail, institutionalized, or dead. Furthermore, being in recovery produces vast social benefits for quality of life and relationships with family, employer, and others, which we do not attempt to measure here. Nevertheless, it is appropriate to incorporate into our estimates some theoretically and empirically relevant factors.

Grim and Grim (2019) then used the US government’s Valuation of a Statistical Life (VSL) to estimate the economic value of these lives saved (median estimate is $US 9.4 million / $C 12.21 million). Using this same figure, the value of recovery support groups located in congregations is $C 4.81 billion per year, as shown in table 10.

Halo Effect B: Adjustment for Charity Impact

Most charities do not produce estimates of the value of their work but rather report on the work, with separate reports of income and expenditures. However, a workshop organized by the Harvard Business School Club of Connecticut (Neiman 2014) found that the return on investment for the participating charities ranged from 2.0 to 7.9 times the amount spent by the charities on their programs.

While the Connecticut workshop is not a rigorous scientific study, a separate, careful study by Partners for Sacred Places and McClanahan Associates, Inc. (2015), quantified the halo effect of the Salvation Army’s Kroc Centers, and found that the total economic benefit to the communities where the charitable work was carried out was about 2.1 times the annual budget of the programs. Thus, applying this arguably conservative ratio to the revenues of faith-based charities adds an additional $1.5 billion to the value estimate (as shown in table 12).

Faith-Related Food Businesses

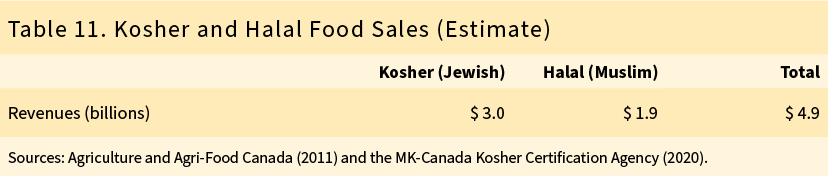

The most obvious and visible faith-related businesses in Canada are the kosher and halal food industries, because both of these require the direct actions of religious authorities to certify compliance with religious dietary requirements. Agriculture and Agri-Food Canada (2011) puts the annual value of halal food business at $1.9 billion, as shown in table 11. The MK-Canada Kosher Certification Agency (2020) reports that close to $34 billion of Canadian food products are kosher, with $3 billion in direct sales to over 8 million consumers who choose to eat kosher. To be conservative and focus on those who make a deliberate decision to eat kosher, we take this latter figure, as shown in table 11.

Note that we do not count sales of food (or other items such as gifts) for religion-based holidays, such as Christmas, although doing so would be conceptually possible. If we did, this would have a dramatic impact. According to Statistics Canada (2017), Christmas-related spending adds as much as $10 billion to the Canadian economy annually. We do not include these sales, because they are not primarily based on the actions of organized faith-based groups but involve the purchasing actions of individuals that may or may not be connected to faith.

Also, there are many companies in Canada whose owners and/or founders view their companies and business as a manifestation of their personal religious faith (Canadian Christian Business Federation n.d.). There were, however, no studies or data available at the time of this report.

Table 12 presents Estimate 2 of the economic contribution of religion to Canadian society ($67.48 billion), which includes these halo adjustments, for an estimate that takes into account revenues from Estimate 1 and includes an economic valuation of the services provided by local congregations, including the economic value of congregation-based recovery support groups, the broader impact of faith-based charity work beyond its direct finances, and the economic activities of faith-related food businesses.

Estimate 3

Revenues of Religiously Affiliated Canadians

Our third estimate is based on the incomes of religiously affiliated people. This a similar methodology used in a study conducted for the World Economic Forum’s Global Agenda Council on the Role of Faith (Grim and Connor 2015). That study connected self-identified religious affiliation with economic environments around the world, including in Canada, seeking to examine how different religious groups will grow both in population and economic power in terms of gross domestic product under their control.

The study for the World Economic Forum employed the best economic and religion data available to present a global view of the shape of future faith and economic change. The project did not aim to provide a direct causal link between religious behaviour and economic practices. Instead, it sought to connect self-identified religious affiliation with economic environments around the world. In this way, religion and religious change is not analyzed as a causal force leading to economic change, nor is economic change analyzed as a causal force in religious change. Instead, the analysis provides a perspective of how the relative size and economic power of religious groups is an integral part of Canadian society and its economy.

Similar to the methodology used in that study, our upper-end estimate of the contribution of religion to Canadian society is based on the estimated annual income of people of faith. For a ballpark estimate, we simply take the share of the adult Canadian population that is religiously affiliated (69%, according to the Pew Research cited earlier) and multiply that by the median household income, for a maximum estimate of $689.5 billion, as shown in table 13. Our intent in providing this estimate is not to achieve precision but to offer another plausible way to take into account the contribution of religion to the Canadian economy.

Discussion and Conclusion

The faith sector is undoubtedly a significant component of the overall Canadian economy, affecting and involving the lives of the majority of the country’s population. We conclude that our first estimate of the economic contribution of religion to Canadian society ($30.87 billion annually) is conservative and an undervaluation, because it focuses on revenues rather than on the value of the goods and services provided by religious organizations.

We believe that our second estimate of $67.48 billion is a more reasonable estimate, because it takes into account both the value of the services provided by religious organizations and the impact of faith-related business.

We offer the third estimate of some $689.5 billion not as a preferred estimate but rather as an upper-end estimate that takes into account religiously affiliated Canadians’ overall contribution to the Canadian economy.

There are several important limitations of this study. First, it does not take into account the value of financial or physical assets of religious groups. Second, it does not account for the negative impacts that occur in some religious communities, including, as mentioned above, such things as the abuse of children by some clergy, cases of fraud, and the possibility of being recruitment sites for violent extremism. Obviously, such actions detract from the positive contributions made by religious institutions and adherents in the same way that they harm society in any context in which they occur—in homes, schools, businesses and friendship networks, as well as in civic, trade, political, and governmental institutions.

The most important limitation of this study is that the estimate of the fair-market value of the goods and services provided by religious organizations is based on the proposition that the findings from other halo-effect studies can be extrapolated up to the national level.

Despite these limitations, we believe that the data and estimates discussed in this paper will be a useful starting point for further studies of the socioeconomic contributions of religion to Canada and perhaps other countries as well.

The data are clear. Religion is a highly significant sector of Canada’s economy. Religion provides purpose-driven institutional and economic contributions to health, education, social cohesion, social services, media, food, and business itself.

References

Agriculture and Agri-Food Canada. 2011. “Global Pathfinder Report Halal Food Trends.” http://publications.gc.ca/site/fra/392958/publication.html.

Alcoholics Anonymous. 2019. “Estimates of A.A. Groups and Members as of January 1, 2019.” https://www.aa.org/assets/en_US/smf-53_en.pdf.

Allen, B. 2019. “From Sacred to Secular: Canada Set to Lose 9,000 Churches, Warns National Heritage Group.” CBC News, March 10. https://www.cbc.ca/news/canada/losing-churchescanada-1.5046812.

Allison, D.J., S. Hasan, and D. Neven Van Pelt. 2016. “A Diverse Landscape: Independent Schools in Canada.” Fraser Institute. https://www.fraserinstitute.org/sites/default/files/a-diverse-landscape-independent-schools-in-canada.pdf.

Ammerman, N.T. 2001. Doing Good in American Communities: Congregations and Service Organizations Working Together. Hartford, CT: Hartford Institute for Religion Research, Hartford Seminary.

ArcGIS. 2018. “2018 Canada Median Household Income.” https://www.arcgis.com/home/item.html?id=6951da2ea34848758d21552792837a09.

Bainbridge, W.S. 1989. “The Religious Ecology of Deviance.” American Sociological Review 54:288–95.

Barrera, J., and L. Fortune. 2019. “Police Hunted for Secret Church Archives During Probe of Abuse Allegations at St. Anne’s Residential School.” CBC News, March 4. https://www.cbc.ca/news/indigenous/archives-st-anne-s-residential-school-abuse-allegations-1.5039150.

Brownell, C. 2018. “Canada’s Top-Rated Charities 2019: Top 100.” MoneySense, November 12. https://www.moneysense.ca/save/financial-planning/canadas-top-rated-charities-2019-top-100/.

Cafardi, N.P. 2008. Before Dallas: The U.S. Bishops’ Response to Clergy Sexual Abuse of Children. New York: Paulist Press.

Calgary Food Bank. n.d. “About Us.” https://www.calgaryfoodbank.com/about/.

Canadian Christian Business Federation. n.d. http://ccbf.org/.

Canadian Fraud News, Inc. 2019. Corporate Fraud. https://www.canadianfraudnews.com/corporatefraud/.

Carranco, S., and J. Milton. 2019. “Canada’s New Far Right: A Trove of Private Chat Room Messages Reveals an Extremist Subculture.” Globe and Mail, April 17. https://www.theglobeandmail.com/canada/article-canadas-new-far-right-a-trove-of-private-chat-room-messages-reveals/.

Celebrate Recovery. 2019. “Find a Group in Canada.” https://www.celebraterecovery.ca/canadiangroups/.

Chaves, M. 1999. “Religious Congregations and Welfare Reform: Who Will Take Advantage of Charitable Choice?” American Sociological Review 64:836–46.

Cnaan, R.A. 2015. “Measuring Social Valuation: The Case of Local Religious Congregations.” Presented at the G20 Interfaith Summit 2015, Istanbul, Turkey, November 17. http://www.iclrs.org/content/events/116/2707.pdf.

Cnaan, R.A., S.C. Boddie, C.C. McGrew, and J.J. Kang. 2006. The Other Philadelphia Story: How Local Congregations Support Quality of Life in Urban America. Philadelphia: University of Pennsylvania Press.

Cnaan, R.A., T. Forrest, J. Carlsmith, and K. Karsh. 2013. “If You Don’t Count It, It Doesn’t Count: A Pilot Study of Valuing Urban Congregations.” Journal of Management, Spirituality and Religion 10:3–36.

Cnaan, R. A., with R.J. Wineburg and S.C. Boddie. 1999. The Newer Deal: Social Work and Religion in Partnership. New York: Columbia University Press.

Daly, M.W. 2016. “The Halo Project, Phase 1: Valuing Toronto’s Faith Congregations.” Cardus. https://www.haloproject.ca/phase-1-toronto/.

De Sanctis, F.M. 2015. Churches, Temples, and Financial Crimes: A Judicial Perspective of the Abuse of Faith. New York: Springer.

Disfold. 2020. “Top 30 Companies of Canada in the TSX Index 2020.” https://disfold.com/topcompanies-canada-tsx/.

Erelle, A. 2015. In the Skin of a Jihadist: Inside Islamic State’s Recruitment Networks. London: HarperCollins.

Fagan, P.F. 2006. “Why Religion Matters Even More: The Impact of Religious Practice on Social Stability.” Heritage Foundation.

Friesen, M. 2017a. “Report 1: Contemporary Cultural Context of Socio-cultural Goods of Religion. Religion and the Good of the City.” Cardus. https://www.cardus.ca/research/social-cities/reports/religion-and-the-good-of-the-city-report-1/.

———. 2017b. “Report 2: State of Research and Influence of Socio-cultural Goods of Religion. Religion and the Good of the City.” Cardus. https://www.cardus.ca/research/social-cities/reports/religion-and-the-good-of-the-city-report-2/.

———. 2017c. “Report 3: Future Conditions of the Socio-cultural Goods of Religion. Religion and the Good of the City.” Cardus. https://www.cardus.ca/research/social-cities/reports/religion-andthe-good-of-the-city-report-3/.

Fukuyama, F. 2001. “Social Capital, Civil Society and Development.” Third World Quarterly 22:7–20.

Gitlow, A.L. 2005. Corruption in Corporate America: Who Is Responsible? Who Will Protect the Public Interest? Lanham, MD: University Press of America.

Greater Toronto Area Intergroup. n.d. “Find a Meeting.” https://www.aatoronto.org/meetings/.

Grim, B.J., and M.E. Grim. 2016. “The Socio-economic Contributions of Religion to American Society: An Empirical Analysis.” Interdisciplinary Journal of Research on Religion 12, art. 3.

———. 2019. “Belief, Behavior, and Belonging: How Faith Is Indispensable in Preventing and Recovering from Substance Abuse.” Journal of Religion and Health 58, no. 5:1713–50.

Grim, B.J., and P. Connor. 2015. “Changing Religion, Changing Economies: Future Global Religious and Economic Growth.” Research prepared for the Global Agenda Council on the Role of Faith. http://religiousfreedomandbusiness.org/wp-content/uploads/2015/10/Changing-religionChanging-economies-Religious-Freedom-Business-Foundation-October-21-2015.pdf.

Heroux, D., and N. Baksh. 2017. “Calgary Mosque Tainted by ‘Dark Element’ of Radicalization to Close Doors This Week.” CBC News, March 30. https://www.cbc.ca/news/canada/calgary/calgarymosque-radicalization-8th-and-8th-1.4042692.

Hummer, R.A., R.G. Rogers, C.B. Nam, and C.G. Ellison. 1999. “Religious Involvement and U.S. Adult Mortality.” Demography 36:273–85.

Johnson, B.R., R.B. Tompkins, and D. Webb. 2002. “Objective Hope—Assessing the Effectiveness of Faith-Based Organizations: A Systematic Review of the Literature.” Manhattan Institute for Policy Research, Center for Research on Religion and Urban Civil Society.

Johnson, T.M. and G. Zurlo, eds. 2019. World Christian Database. Boston: Brill. https://worldchristiandatabase.org/.

Kinney, N.T., and T.B. Combs. 2015. “Changes in Religious Ecology and Socioeconomic Correlates for Neighborhoods in a Metropolitan Region.” Journal of Urban Affairs 38, no. 3:409–28.

Koenig, H., and M. McConnell. 1999. The Healing Power of Faith: How Belief and Prayer Can Help You Triumph Over Disease. New York: Touchstone.

Koenig, H., D. King, and V.B. Carson. 2011. Oxford’s Handbook of Religion and Health. 2nd ed. Oxford: Oxford University Press.

Lester, D. 1987. “Religiosity and Personal Violence: A Regional Analysis of Suicide and Homicide Rates.” Journal of Social Psychology 127:685–86.

Lipka, M. 2019. “5 Facts About Religion in Canada.” Pew Research Center. https://www.pewresearch.org/fact-tank/2019/07/01/5-facts-about-religion-in-canada/.

MacLeod, A., and J. Emes. 2019. “Education Spending in Public Schools in Canada: 2019 Edition.” Fraser Institute. https://www.fraserinstitute.org/studies/education-spending-in-publicschools-in-canada-2019.

MK-Canada Kosher Certification Agency. 2020. “About Us.” https://mk.ca/about-us/.

Moushey, B., and R. Dvorchak. 2013. Game Over: Jerry Sandusky, Penn State, and the Culture of Silence. New York: HarperCollins.

Muller, C., and C.G. Ellison. 2001. “Religious Involvement, Social Capital, and Adolescents’ Academic Progress: Evidence from the National Education Longitudinal Study of 1988.” Sociological Forces 34:155–83.

Natural Resources Canada. 2013. “Survey of Commercial and Institutional Energy Use: Establishments 2009.” https://oee.nrcan.gc.ca/publications/statistics/scieu/2009/pdf/SCIEU2009Establishments.pdf.

NCEE. 2019. “Canada: Governance and Accountability.” Center on International Education Benchmarking. http://ncee.org/what-we-do/center-on-international-educationbenchmarking/top-performing-countries/canada-overview/canada-system-and-schoolorganization/.

Neiman, R.A. 2014. “Your Nonprofit Is Worth More Than You Think! A Formula for Measuring Economic Value.” Workshop report. http://hbsconnecticut.org/s/1738/images/gid18/editor_documents/tbt419.pdf.

Neumann, P.R. 2008. Joining al-Qaeda: Jihadist Recruitment in Europe. London: International Institute for Strategic Studies.

Numrich, P.D., and E. Wedam. 2015. Religion and Community in the New Urban America. New York: Oxford University Press.

Ontario Trillium Foundation and Partnership Network. 2020. “No Space for Community: In Depth Look into Loss of Community Infrastructure Due to the Closure of Faith Buildings in Ontario.” https://www.faithcommongood.org/community_spaces_faith_places_survey_results.

Our Kids. n.d. “List of Faith Based Schools.” https://www.ourkids.net/index.php. Pajot, Robert. 2020. Private correspondence with lead author. June 24.

Partners for Sacred Places and McClanahan Associates, Inc. 2015. “The Economic Halo Effect of The Salvation Army Ray & Joan Kroc Corps Community Centers.” Report to the Salvation Army. May.

Pellowe, J. 2018. “The Impact of the ‘Advancing Religion’ Charitable Sub-sector in Canada: Submission to the Special Senate Committee on the Charitable Sector, November 23, 2018.” Canadian Council of Christian Charities. https://sencanada.ca/content/sen/committee/421/CSSB/Briefs/CanadianCouncilofChristian_e.pdf.

Picarello, A.R., Jr., J.H. Moon, M.F. Moses, and United States Conference of Catholic Bishops. 2016. “Brief Amicus Curiae of United States Conference of Catholic Bishops; Institutional Religious Freedom Alliance; World Vision, Inc.; Catholic Relief Services; Family Research Council; Association of Catholic Colleges and Universities; Thomas More Society; and the Cardinal Newman Society in Support of Petitioners and Supporting Reversal.” http://www.scotusblog.com/wp-content/uploads/2016/01/Zubik-USCCB-brief.pdf.

Putnam, R. 2000 [1990]. Bowling Alone: The Collapse and Revival of American Community. New York: Simon & Schuster.

Ramlakhan, K. 2019. “Former Church Treasurer Sentenced in ‘Sad’ Fraud Case.” CBC News, October 4. https://www.cbc.ca/news/canada/ottawa/former-church-st-luke-lutheran-treasurersentenced-two-years-prison-embezzling-fraud-1.5309043.

Regnerus, M.D. 2001. “Making the Grade: The Influence of Religion upon the Academic Performance of Youth in Disadvantaged Communities.” University of Pennsylvania, Center for Research on Religion and Urban Civil Society Report No. 3, 44:394–413.

Reimer, S., M. Chapman, R. Janzen, J. Watson, and M. Wilkinson. 2016. “Christian Churches and Immigrant Support in Canada: An Organizational Ecology Perspective.” Review of Religious Research 58:495–513. https://doi.org/10.1007/s13644-016-0252-7.

Schwadel, P. 2002. “Testing the Promise of the Churches: Income Inequality in the Opportunity to Learn Civic Skills in Christian Congregations.” Journal for the Scientific Study of Religion 41, no. 3:565–75.

Schwartz, Z. 2018. “Canadian Universities Are Failing Students on Sexual Assault.” Maclean’s, March 1. https://www.macleans.ca/education/university/canadian-universities-are-failing-students-onsexual-assault/.

Seljak, D. 1996. “Why the Quiet Revolution was ‘Quiet’: The Catholic Church’s Reaction to the Secularization of Nationalism in Quebec after 1960.” CCHA, Historical Studies 62:109–24.

Statistics Canada. 2016. “Census Profile, 2016 Census.” https://www12.statcan.gc.ca/censusrecensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=PR&Code1=01&Geo2=PR&Code2=01&Data=Count&SearchText=01&SearchType=Begins&SearchPR=01&B1=All&Custom=&TABID=3.

———. 2017. “Christmas . . . by the Numbers.” https://www.statcan.gc.ca/eng/dai/smr08/2017/smr08_222_2017.

———. 2018. “Elementary-Secondary Education Survey for Canada, the Provinces and Territories, 2016/2017.” https://www150.statcan.gc.ca/n1/daily-quotidien/181102/dq181102c-eng.htm.

Tirrito, T., and T. Cascio. 2003. Religious Organizations and Community Services: A Social Work Perspective. New York: Springer.

Top Private Schools. n.d. “Private Catholic Schools in Canada.” https://topprivateschools.ca/list_religion.asp?religion=Catholic.

United Church of Canada. n.d. “Sponsoring an LGBTIQ2+ Refugee.” https://www.united-church.ca/social-action/justice-initiatives/sponsoring-lgbtiq2-refugee.

World Bank. 2019. “GDP (Current US$).” https://data.worldbank.org/indicator/NY.GDP.MKTP.CD.

Zak, P.J. and S. Knack. 2001. “Trust and Growth.” Economic Journal 111:295–321.