Table of Contents

Table of Contents

Executive Summary

This paper surveys the municipal construction market in the Region of Waterloo and studies the effect of the removal of restrictions on bidding in that market. Specifically it examines the competitiveness of the Region of Waterloo’s public construction procurement over three distinct periods of time: first, when it was open to competitive bidding; second, when it was restricted to firms affiliated with one particular union; and third, when provincial legislation re-established competitive bidding. Competitiveness measures include the number of bids, number of unique firms bidding, number of unique bidders, as well as bid differentials and the placement of various firms in each time frame studied.

Our results show that the construction procurement in the Region of Waterloo was highly competitive prior to restrictions; that it suffered major losses in number of unique firms bidding, number of bids, and number of winning firms in the period during which the bidding was restricted; and that it saw the gaps between bids spread, indicating upward pressure on municipal construction costs. Our results show that the removal of restrictions enabled the Region of Waterloo to “bounce back” toward its original competitive state. The removal of restrictions led to a greater numbers of bids, more bidders, more unique firms bidding, and decreased bid gaps indicating downward pressure on municipal construction costs.

The results reaffirm the importance of a diverse, competitive bidding pool in municipal procurement and the negative effects of policies that serve to restrict the diversity of firms that, absent those restrictions, would be qualified to bid on municipal construction projects.

Introduction

Cardus has examined factors related to restrictive tendering from a variety of angles, in the set of papers that form the Cardus Construction Competitiveness Monitor. 1 1 B. Dijkema, “Cardus Construction Competitiveness Monitor,” Cardus, October 2012, https://www.cardus.ca/research/work-economics/reports/cardus-construction-competitiveness-monitor/; B. Dijkema, “Tuning Up Ontario’s Economic Engine: A Cardus Construction Competitiveness Monitor Brief,” Cardus, April 2015, https://www.cardus.ca/research/work-economics/reports/tuning-up-ontarios-economic-engine-a-cardus-construction-competitiveness-monitor-brief/; M. Gunderson, B. Dijkema, and T. Zhang, “Up, Up, and Away: The Impact of Restrictive Tendering on Municipal Contracting in Ontario,” Cardus, December 2017, https://www.cardus.ca/research/work-economics/reports/up-up-and-away/; B. Dijkema, “No Longer the Best: The Effects of Restrictive Tendering on the Region of Waterloo,” Cardus, March 2018, https://www.cardus.ca/research/work-economics/reports/no-longer-the-best-the-effects-of-restrictive-tendering-on-the-region-of-waterloo/; B. Dijkema, “Shortchanging Ontario’s Cities: A Cardus Competitiveness Monitor Update,” Cardus, September 2018, https://www.cardus.ca/research/work-economics/reports/shortchanging-ontarios-cities/. This paper provides further observations on the impact of restrictions and competition on municipal construction markets, using data from a specific local market, the Region of Waterloo.

Restrictive tendering 2 2 For details on the legal and economic implications of restricted tendering, see Gunderson, Dijkema, and Zhang, “Up, Up, and Away.” was the result of provincial law, which required municipalities to accept bids from a small group of contractors on the basis of the union affiliation of a firm’s workers. While ostensibly the matter was one of construction purchasers and contractors, the law affected workers and companies, local communities, and citizens.

This paper focuses on data from one particular municipality, the Region of Waterloo. The Region has gone through three separate phases in its construction tendering:

- Prior to July 4, 2014. A period of open and competitive tendering, when all qualified bidders could bid on public work, regardless of the affiliation of their workers.

- July 2014 to July 2019. A period of restricted tendering that followed after the Region was certified as a “construction employer” for the Industrial, Commercial, and Institutional (ICI) sector and became a signatory to the provincial collective agreement of the Carpenters’ union on July 4, 2014. At that time, the Ontario Labour relations board “concluded that two employees in the bargaining unit were engaged in work within the construction industry and within the bargaining unit on the date of the application and that the responding party is not a non-construction employer within the meaning of the Ontario Labour Relations Act.” 3 3 Carpenters’, United Brotherhood of Carpenters and Joiners of America v. Waterloo (Regional Municipality), [2014] CanLII 38344 (ON LRB), https://www.canlii.org/en/on/onlrb/doc/2014/2014canlii38344/2014canlii38344.html. The “work within the construction industry” in this case was a garden shed on the Region’s grounds. The subcontracting clause of the collective bargaining agreement, which the Region was required to follow, required that only firms affiliated with the Carpenters’ union could bid on ICI work in the Region of Waterloo. All other firms were legally barred from bidding on work in the Region on the basis of the affiliations of their workers.

- July 2019 to present. Bill 66, the relevant portions of which became law on July 3, 2019, changed the legal definition of a “construction employer” in such a way that municipalities and other public entities were deemed different in nature than for-profit construction firms and were no longer deemed to be construction employers. This change enabled the Region to return to open and competitive tendering whereby all qualified firms, regardless of the affiliations of their workers, were allowed to bid on public projects.

The Cardus report “No Longer the Best: The Effects of Restrictive Tendering on the Region of Waterloo” 4 4 Dijkema, “No Longer the Best.” studied the effects of the change to closed tendering on the Region and found that restrictive tendering resulted in significantly fewer bidders overall, significantly fewer bids per project, and increasing gaps between bids, indicating upward pressure on construction prices.

This paper studies the effect of the recent legal change in the Region that removed restrictions and allowed it to open its bids to all qualified contractors. What did we find? Read on to find out.

Observations

Profile of Contractors and Percentage of Unionized Contractors in the Region of Waterloo

In our data set provided by public records dating from July 2019 (the date when restrictions on bidding in the Region of Waterloo were removed) to January 14, 2021, there were seventy-four unique contractors who bid on work in the Region.

Cardus analyzed the union certification status of these contractors through searches conducted in the Canadian Legal Information Institute’s database, 5 5 See Canadian Legal Information Institute, https://www.canlii.org/en/. referencing membership directories of unionized contractors and their associations 6 6 See Unionized Construction Works, http://unionizedconstructionworks.com/directory/. and the Ontario Labour Relations Board Collective Agreement Library. It is important to note that the nature of labour relations is fluid, and observations that are true upon publication may later change. Ontario labour relations law provides workers with the ability to unionize if they can show sufficient support at any time, and unionized firms may see changes in their union status if workers choose to leave a union during so-called open periods (decertifying) or to change their union during the same open periods. That said, while these directories and lists are not comprehensive, they do provide the best public information on which firms are unionized and which are not.

Our research suggests that five of the contractors that bid on the Region’s projects operate under the provincial ICI agreement of the Carpenters’ Union, or approximately 7 percent of all bidders. The other 93 percent of bidders during this period would previously have been prevented from bidding.

For all of our observations, we had complete data drawn from public bids provided by the Region of Waterloo. That is, we had the company name and the bid price for all bidders for all twenty-six projects.

Characteristics of Bidding Environment Prior to and Following Certification

Using the data set described above, Cardus analyzed the bids related to the twenty-six projects tendered between 2019 and 2021, when the Region tendered under a competitive regime following the passage of Bill 66. We compared these bid data to the twenty-two projects tendered from 2014 to 2017 under a restrictive regime, which we had examined in our previous research brief “No Longer the Best.” 8 8 Dijkema, “No Longer the Best.” Projects that were tendered prior to July 3, 2019, the date on which restrictions were lifted via the specifications of Bill 66, are considered closed, while those opened for tender after this time are considered open. 9 9 Bill 66 received Royal Assent on April 3, 2019, but Schedule 9 of the bill specified that relief of restrictions on municipal tendering would not take effect until three months after the bill received Royal Assent. See Legislative Assembly of Ontario, Bill 66, An Act to Restore Ontario’s Competitiveness by Amending or Repealing Certain Acts, April 3, 2019, https://www.ola.org/sites/default/files/node-files/bill/document/pdf/2019/2019-04/b066ra_e.pdf. Below are some observations and characteristics of the two regimes drawn from the data set available to us.

Projects Won by Carpenters’-Affiliated Firms in Open Environment

In the competitive environment, there was one project won by firms affiliated with the Carpenters’ Union. The Region officially awarded that project (T2019-173 Connection of Well G6 Turnbull Water Treatment Plant, won by the sole bidder W.S. Nicholls) in September of 2019. It was originally advertised and bid documents were provided on July 15, 2019. 10 10 Region of Waterloo, “Well G6 Turnbull Water Treatment Plant Bidding Documents,” https://regionofwaterloo.bidsandtenders.ca/Module/Tenders/en/Tender/Detail/05a8563a-9df4-4c31-bae2-eed9acd131bd. This project was the first project to be tendered under non-restrictive conditions.

Best Placing of Carpenters’ Firm in Open Environment Under Competitive Conditions

The lowest non-winning placement of a Carpenters’-affiliated firm in that time was, to the best of our knowledge, second place, which occurred once.

Average Placement of Carpenters’-Affiliated Firms

The average placement of Carpenters’-affiliated firms was fourth place.

Significant Numbers of Projects Had Zero Bids from Carpenters’-Affiliated Firms

Out of twenty-six projects in that time period, twenty-one had zero Carpenters’ bids. That is, on 81 percent of projects, Carpenters’-affiliated firms did not bid at all.

Average Number of Bidders in Open Environment Versus Closed Environment

There were an average of 5.54 bids per project for the twenty-six projects in the competitive, post–Bill 66 period. The lowest number of bids received on a project was one, and the highest number of bidders was twenty-two.

There were an average of 3.68 bids per project among the twenty-two projects in the restrictive period. That is, the number of bids the Region was receiving per project was, on average, 50 percent higher in the competitive environment.

Again, as with the number of contractors, 5.54 bids per project indicates a rebound of 68 percent toward the competitive environment, which saw an average of 8.14 bids per project, suggesting that the Region is returning to the competitive environment in which larger number of bidders compete to offer the lowest price.

Notable Characteristics of Bids in Open Environment Versus Closed Environment

Eight projects of the twenty-two, or 36 percent, in the restricted period received only one (four projects) or two (four projects) bids. The highest number of bidders on a project in the restrictive period was eight.

In the post–Bill 66 competitive period, four projects of the twenty-six, or 15 percent, received only one (one project) or two (three projects) bids. The highest number of bidders in the open and competitive environment was twenty-two. The second highest number of bidders was nine.

Bid Gap Analysis

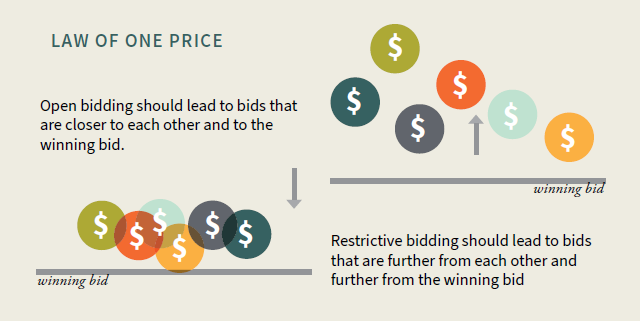

We also performed an analysis of the bid gaps in the Region of Waterloo using the same methodology as in “Up, Up, and Away” 11 11 Dijkema, Gunderson, and Zhang, “Up, Up, and Away.” and “No Longer the Best.” 12 12 Dijkema, “No Longer the Best.” As we noted in those papers, the law of lowest price says that in a competitive environment the gap between winning bids and second bids, and the gap between bids overall, would be smaller and tend toward zero (see Figure 6).

Smaller bid gaps indicate greater competition, downward pressure on costs to municipalities, and lower prices. Our analysis shows that in the open period, this is indeed what occurred:

Before/restricted: (Yw – Yn) / Yn = -0.07496

After/open: (Yw – Y n) / Yn = -0.06726

Difference between restricted/open (before-after) = -0.00770

Y denotes the dollar value of the bid, the subscript w denotes the winning bid, and the subscript n denotes the benchmark of the runner-up bid, which is almost always the next-lowest bid.

While the sample size is small and we don’t have direct comparisons with neighbouring jurisdictions, there is nonetheless a decrease in the bid gaps of 11 percent, again suggesting downward pressure on prices in a relatively short time. As with “Up, Up, and Away,” projects that have one bid (and thus no gap) are not included.

Additionally, we performed an analysis of the post–Bill 66 period on bid spreads, similar to that which was done of the aggregate data as a whole. In the open period, we analyzed the results to answer the question: What would be the spread between the winning bid and the next bid if only Carpenters’ firms counted, and how would that compare to the spread between bids of the winning and the next lowest firm?

On the five projects for which Carpenters’ firms bid, the mean gap between the winning bid and the Carpenter’s firm bid was -0.12045, and the mean gap between the winning bid and the next highest bid of -0.06726. In other words, the mean gap between the winning bid and the next Carpenter’s firm bid was approximately 80 percent wider than in a fully competitive environment. Overall, Carpenters’-affiliated firm prices diverged significantly from the lowest price.

Price Differentials

While it is not possible to note price differentials with complete certainty, it is possible to note the percentage difference in prices between Carpenters’-affiliated firms and winning bids. Of the five jobs in which the Carpenters’-affiliated companies did bid, the lowest of such bids were 24 percent, 12 percent, 18 percent, 14 percent, and 2 percent higher than the winning bid. This represents an average of 14 percent higher. If we apply that price differential to the total amount of money spent on the projects surveyed ($170,810,512), the Region saved about $24 million (equal to the price of the Galt Wastewater Treatment Plant upgrades and a number of smaller jobs combined). This is a low estimate, as Carpenters’ firms did not bid on the vast majority of projects.

In most tenders, Carpenters’ firms are simply absent. There may be a number of reasons for this. The construction market overall during the study period was very busy, and Carpenters’ contractors may have chosen to focus their work elsewhere where they could earn more profit, or they may have lacked capacity to bid. The absence of Carpenters’-affiliated firms also suggests that the presence of such a wide array of new bidders, and the tightening of competition for projects, rendered Carpenters’ firms—which previously held an oligopoly on municipal contracts—uncompetitive on price.

To provide price differential estimates for such a situation, one might assume that the Region is saving money equal to the highest bid plus $1.00 or, alternatively, the highest bid plus the average dollar difference in bids. One example from the T2019-160 Strange Street Water Supply System job suggests that the Region saved a minimum of 10 percent. On another, the T2020-106 Contract 5A, Maintenance Standby Digested Sludge Storage Tank and Control Building Upgrades job, the Region saved a minimum of 40 percent. While it is not possible to provide an exact dollar amount, one can say with a high degree of confidence that the diversity of bidders is paying off for the Region and its citizens through increased competition and downward pressure on prices.

Number of Firms Bidding in Open Environment Versus Closed Environment

The number of unique firms that bid in the certification period, including Carpenters’, was fifteen. The number in the open period was seventy-four. In other words, the Region is now accepting bids from nearly five times the number of bidders it did in the closed period. This represents a return to the number of unique contractors bidding in a competitive environment with no restrictions. The seventy-four unique bidders represent 81 percent of the total number of unique bidders in Waterloo prior to its restriction, suggesting a return to the contractor diversity that used to be present in Waterloo when it was open.

Number of Winning Firms in Open Environment Versus Closed Environment

The Region also experienced greater diversity among those who won projects. Whereas a comparison of winners to number of bidders in the restricted period reveals a ratio of nine winners to twenty-two projects (41 percent), in the open period there were eighteen winners to twenty-six projects (69 percent).

Analysis and Commentary

The sample size in this study is not huge, but the data do provide a picture of the immediate effect of moving from restrictive to competitive tendering on one local market. All points in the data suggest that those immediate effects are positive. The movement toward competitive tendering has returned the Region toward the ideal environment for local workers, local contractors, and, most importantly, the Region and its community of citizens.

There is little doubt that the increase in the number of bidders can be attributed to anything other than the increased competition resulting from Bill 66. In contrast to the significant reduction in the number of bidders and the concentration of reduction of the winners that came with restrictions in 2014, the move to increased competition has massively increased the diversity of bidders and winners.

Moreover, the significant decrease in projects with only one or two bidders moves the Region away from the worst-case scenario for procurement officials looking to ensure that the public receives best value for money on construction projects, which was present when restrictions were in place. This is important for a number of reasons. The first, as noted in previous Cardus papers, is that studies have shown that prices increase when the number of bidders declines. In particular, we noted studies from Montreal demonstrating that, due to analogous restrictions on bidders, the city was overpaying up to 30 percent for its construction contracts. We also noted studies from the University of Texas, showing that projects receiving eight bids resulted in prices up to 25 percent lower than projects receiving only two. 13 13 Bauld and Dijkema, with Tonn, “Hiding in Plain Sight”; Dijkema, Gunderson, and Zhang, “Up, Up, and Away.” The removal of restrictions has resulted in the exact opposite: more bidders, increased downward pressure on prices, and massive savings, as we note from the price differentials between winning bids and the bids of companies that under restrictive conditions would have had exclusive bidding rights. It can be said with a high degree of confidence that these savings are present in the Region of Waterloo.

We noted in our previous paper that restrictive tendering caused “firms that used to be middling performers in the competitive environment [to] now have exclusive rights over all of the Region’s work.” 14 14 Dijkema, “No Longer the Best.” Our data show that the return of competition has the opposite effect. The middling firms are either absent or have returned to the middle, and firms able to offer competitive prices are winning the overwhelming majority of bids.

Restrictive tendering creates a coercive oligopoly that disproportionately benefits a small group of firms that are able to increase profits at the cost of taxpayers because they experience reduced competition on price. Oligopolies of the sort created by closed tendering disproportionately benefit the owners of a small number of firms at the cost of other firms, their workers, and the public at large.

The latter point is particularly important as municipalities seek to increase diversity in procurement processes. Restricting bidding on the basis of union affiliation significantly restricts the pool of available labour and owners and, as a matter of course, decreases sectoral diversity.

Conclusion and Policy Implications

This study confirms a pattern that economic theory and countless empirical studies have shown: increased competition leads to downward pressure on prices and increased diversity in procurement markets. The results of our study, which show price savings of at least 14 percent, are in line with other empirical observations from municipal authorities. For instance, the City of Hamilton, which also moved to a competitive tendering process as a result of Bill 66, produced a report by the city’s procurement team that led to almost identical conclusions. The authors found price savings in the range of 9 to 32 percent, with an average savings of 21 percent. 15 15 City of Hamilton, “Minutes of City of Hamilton General Issues Committee Revised,” June 19, 2019, https://pub-hamilton.escribemeetings.com/FileStream.ashx?DocumentId=196165, 101–2. They also noted that “broader procurement opportunities will result in expanded access to the City’s construction procurement” among a greater diversity of bidders. Further, they noted that open tendering will enable them to better follow their own policies on equitable treatment of vendors. Their policy sets out to “encourage an open and competitive bidding process for the acquisition and disposal of Goods and/or Services, and the objective and equitable treatment of all vendors. Becoming a non-construction employer will significantly and positively affect the City’s ability to be open and fair to all bidders regardless of their union affiliation.” 16 16 City of Hamilton, “Minutes of City of Hamilton.”

As municipalities such as Toronto, which neglected to follow its own best practices and left restrictions in place, seek ways to increase the diversity of their procurement markets, and to build more infrastructure with limited tax dollars, one policy choice is obvious: remove the restrictions.

What we have noted in previous papers is only more true today: there is no compelling public-interest case, or evidence, for closed tendering.

References

Bauld, S., and B. Dijkema with J. Tonn. “Hiding in Plain Sight: Evaluating Closed Tendering in Construction Markets.” Cardus, 2014. https://www.cardus.ca/research/work-economics/research-report/hiding-in-plain-sight-evaluating-closed-tendering-in-construction-markets/.

Carpenters’, United Brotherhood of Carpenters and Joiners of America v. Waterloo (Regional Municipality). [2014] CanLII 38344 (ON LRB). https://www.canlii.org/en/on/onlrb/doc/2014/2014canlii38344/2014canlii38344.html.

City of Hamilton. “Minutes of City of Hamilton General Issues Committee Revised.” June 19, 2019. https://pub-hamilton.escribemeetings.com/FileStream.ashx?DocumentId=196165.

Dijkema, B. “Cardus Construction Competitiveness Monitor.” Cardus, October 2012. https://www.cardus.ca/research/work-economics/reports/cardus-construction-competitiveness-monitor/.

———. “No Longer the Best: The Effects of Restrictive Tendering on the Region of Waterloo.” Cardus, March 2018. https://www.cardus.ca/research/work-economics/reports/no-longer-the-best-the-effects-of-restrictive-tendering-on-the-region-of-waterloo/.

———. “Shortchanging Ontario’s Cities: A Cardus Competitiveness Monitor Update.” Cardus, September 2018. https://www.cardus.ca/research/work-economics/reports/shortchanging-ontarios-cities/.

———. “Tuning Up Ontario’s Economic Engine: A Cardus Construction Competitiveness Monitor Brief.” Cardus, April 2015. https://www.cardus.ca/research/work-economics/reports/tuning-up-ontarios-economic-engine-a-cardus-construction-competitiveness-monitor-brief/.

Dijkema, B., M. Gunderson, and T. Zhang. “Up, Up, and Away: The Impact of Restrictive Tendering in Municipal Contracting in Ontario.” Cardus, December 2017. https://www.cardus.ca/research/work-economics/reports/up-up-and-away/.

Legislative Assembly of Ontario. Bill 66. An Act to Restore Ontario’s Competitiveness by Amending or Repealing Certain Acts. April 3, 2019. https://www.ola.org/sites/default/files/node-files/bill/document/pdf/2019/2019-04/b066ra_e.pdf.

Region of Waterloo. “Well G6 Turnbull Water Treatment Plant Bidding Documents.” https://regionofwaterloo.bidsandtenders.ca/Module/Tenders/en/Tender/Detail/05a8563a-9df4-4c31-bae2-eed9acd131bd.